There’s a credit card for everyone out there — which means there are cards that are explicitly not for everyone. We gather the 10 most exclusive credit cards in the world to give you an idea of perks and financial needs your typical millionaire might need. (If you’re a millionaire, then maybe you’ll find a card to add to your wish list.)

We looked at a card’s luxury factors, including high cost, exclusive membership, construction from precious metals, luxury perks and high credit limits. Of course, a high net worth is a prerequisite for these 10 exclusive cards.

And in many cases, membership is extended by invitation only. If you can get one, you’ll enjoy a generous credit limit, luxury travel perks and bespoke concierge service.

The top 10 most exclusive credit cards

1. Centurion® Card from American Express

Known as the Black Card, the Centurion® Card from American Express is an elusive and exclusive card issued by invitation only. To be invited, you reportedly must have spent and paid off at least $250,000 across your Amex accounts in a single year.

To join this exclusive club of Centurion cardmembers, you must pay a $7,500 initiation fee. And the card itself comes with a $2,500 annual fee.

The card has no preset purchase limit for flexible spending. You’ll have access to a personal concierge who can fulfill any request you can dream of. It also offers luxury perks that Amex takes great pains not to advertise: Exclusive treatment at best-in-class Centurion airport lounges, world-class surprise gifts, reservations at 1,000 of the world’s best restaurants and a suite of luxury travel benefits.

Exclusive bona fides

Centurion Lounges are already exclusive, only accessible to those who can flash American Express Platinum Card®, The Business Platinum Card® from American Express, the American Express Corporate Platinum Card or Centurion® Card from American Express.

But even in these top-notch lounges, you’ll find perks reserved for Black Card members only. As of March 2019, American Express eliminated Centurion Lounge access for members arriving at their destination — a policy that doesn’t apply to Black Card members.

Dropping into Hong Kong International Airport? HK’s Centurion Lounge offers an exclusive dining section for Black Card members. There, you’ll enjoy a menu crafted by Michelin-starred chef Lau Yiu Fai, as well as premium, complimentary wines and Champagnes.

2. J.P. Morgan Reserve Card

This card is made of palladium, a silvery white chemical element that — valued at $1,295 an ounce — rivals gold in cost. It’s offered by invitation only to J.P. Morgan’s top clients, who must have at least $10 million in assets under management by J.P. Morgan Private Bank.

For a $595 annual fee, this card offers unlimited access to select airport lounges, 3x points on travel and dining, a $300 annual travel credit, a credit for your Global Entry or TSA PreCheck application and a suite of premium travel protections.

You’ll get 24/7 direct access to a dedicated customer service specialist. And you can breathe easy when making extravagant purchases, as they’re covered for 120 days against theft or damage for up to $10,000 per claim.

Exclusive bona fides

The previous version of this card, the Chase Palladium, is a rumored favorite of former President Barack Obama.

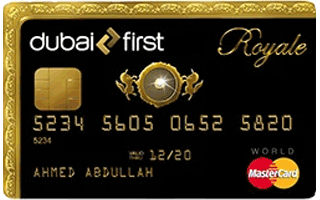

3. Dubai First Royale Mastercard

Embedded with a 0.235-carat diamond at its center and trimmed with gold, this elaborate card is Dubai First’s exclusive offer to UAE royalty and the region’s high net worth individuals.

The card is by invite only, and you may be ineligible even if you are ultrawealthy. The initiation fee is 7,000 UAE dirham — roughly $1,900.

It has few of the standard benefits present in most credit cards, which may not matter to those wealthy enough to receive it. Unhampered by a credit limit, you could reportedly buy a yacht on a whim if you’d like. And with 24/7 access to what the bank bills as Royale Lifestyle Management — complete with a dedicated lifestyle manager — you can connect to virtually anything you desire.

Exclusive bona fides

Dubai First isn’t kidding about setting no credit limit for this card. Ibrahim al Ansari, the firm’s CEO, was quoted by leading UAE newspaper The National:

“The needs of these clients are different. Whatever he or she wants to swipe [the Dubai First Royale Mastercard] on, the transaction must go through. If the client likes a yacht on holiday, he or she should be able to buy it.”

4. Coutts Silk Credit Card

Owned by the Royal Bank of Scotland (RBS), Coutts serves high net worth clients exclusively. Its prospective client questionnaire gets straight to business: At one point it asks whether you’ll bring investable assets to Coutts totaling more than 1 million pounds. If your answers to this or other questions prove you aren’t wealthy enough — or won’t imminently become so — Coutts will gently suggest you try another bank.

If you’re wealthy enough to become a Coutts client, you can apply for the Coutts Silk Credit Card. The card has no annual or foreign transaction fees and lets you enter airport lounges around the world through LoungeKey. Plus, you get access to exclusive events and experiences through the Coutts signature loyalty program, as well as 24/7 service from Coutts Concierge.

Exclusive bona fides

The firm counts the British royal family among its distinguished clients.

5. Sberbank Visa Infinite Gold Card

If pure gold isn’t enough, how about throwing in mother of pearl and 26 diamonds? Issued by Kazakhstani outfit Sberbank to only 100 of its top clients initially, this Visa Infinite card costs a neat $100,000 up front. Of this money, an unheard-of $65,000 goes to minting the card. The other $35,000 is directed to your account. On top of the initiation fee, you’ll be out another $2,000 for an annual fee.

If you get the card, you’ll have the pleasure of owning a solid-gold status symbol. Enjoy $250,000 of life and health insurance, 24/7 concierge service and a personal manager at Sberbank. Get VIP access to luxury vacations and the world’s finest golf courses. And if you forget to pay your card bill while jetting around the world, rest easy knowing the card has no late fees.

Exclusive bona fides

This card has an extraordinary claim to fame: It’s the world’s first credit card that, according to Sberbank, is made exclusively from gold, pearl and diamonds. It doesn’t even have a magnetic strip.

6. Eurasian Diamond Card Visa Infinite

Another Kazakhstani gem, the Eurasian Bank Diamond Card Visa Infinite is an elite product you can’t apply for. This striking black card features an inlaid gold ornament with a 0.02-carat diamond centerpiece, and you can obtain it only through recommendation by the bank’s management board or two existing cardholders.

Annual card fees range from 150,000 to 450,000 Kazakhstani tenge — roughly $395 to $1185 — depending on your balance with Eurasian Bank. Top concierge companies ensure the world is at your fingertips, offering exclusive hotel bookings, visa services, private plane arrangements, translation services, butler services and more.

Exclusive bona fides

The minimum balance you need at Eurasian Bank to qualify for this card is 15 million Kazakhstani tenge — roughly $39,500. But the bank may invite you to become a cardholder if you are, in its words, “a customer of a high social standing.”

7. Stratus Rewards Visa

Known as the White Card, the Stratus Rewards Visa is often seen as the definitive card for jet-setters. To get it, you need a referral from an existing cardmember or a Stratus Rewards partner company before you’re even considered for an exclusive invitation.

It features a rewards program that lets cardholders travel on private jets or charter flights. And if you’d like, you can redeem your rewards for a personal consultation with a famed lifestyle expert. At $1,500 a year, this card gives you access to personal concierge services, discounted charter flights, complimentary car services, luxury hotel upgrades, special events and exclusive gift bags.

Exclusive bona fides

This card is designed for those who spend big as a matter of habit. Rumor has it you must spend at least $200,000 a year with the card to remain a member.

8. The Merrill Lynch Octave Black Card

Made of black metal and sporting an American Express logo, the Merrill Lynch Octave Black Card is an invitation-only card that caters to the American bank’s highest net worth clients. To qualify, you must have at least $10 million in a Merrill Lynch account.

Cardholders pay $950 in annual fees and reportedly enjoy such perks as no preset credit limit, 2.5x points on all eligible purchases, an annual $350 travel credit or Delta SkyClub Executive Membership, private jet savings and access to airport concierges.

Exclusive bona fides

Merrill Lynch is a firm that serves high net worth clientele. Merrill brokers reportedly aren’t compensated if they advise new clients who bring to them less than $250,000 in assets. The point: They’re expected to serve wealthier clients — those who contribute more to the firm’s bottom line.

9. Santander Unlimited Black Card

This understated black card is the product Brazilian Santander Group offers to its elite private banking customers. It’s rumored that only a few thousand cards are in circulation.

The card offers high, flexible spending limits, 24/7 concierge service, LoungeKey membership, travel insurance, Mastercard Airport Concierge and special experiences at fine hotels and restaurants. As of December 2022, the Santander website states this card has no annual fee.

Exclusive bona fides

The Santander Unlimited is a Mastercard Black. The US’s closest equivalent is the Mastercard World Elite.

Mastercard Black extends elite travelers access to the exclusive Mastercard VIP Lounge at Brazil’s Guarulhos Airport, located in Terminal 3. The only other way to get in is by accompanying a cardholder.

10. Luxury Card Mastercard® Gold Card™

Front-plated with 24-karat gold, the card offers access to Luxury Card Concierge and perks like global luggage delivery, chauffeured transportation and airport representatives who can fast-track you through customs. You’ll also enjoy premium travel benefits like airline credits, airport lounge access and a $120 credit for your Global Entry or TSA Pre✓® application.

(Terms apply, see rates & fees)

Exclusive bona fides

This card’s construction is so exclusive, Luxury Card protects its design — loaded with gold, stainless steel and carbon — with 83 global patents.

How much do these exclusive cards cost?

| Card | Annual fee | Initiation fee | Reported requirements |

|---|---|---|---|

| Centurion® Card from American Express | $2,500 | $7,500 | Spend and pay off at least $250,000 across your Amex accounts in a single year. |

| JP Morgan Reserve Card | $595 | Available upon request |

|

| Dubai First Royale Mastercard | Available upon request | Approximately $1,900 |

|

| Dubai First Royale Mastercard | Available upon request | Approximately $1,900 |

|

| Coutts Silk Credit Card | None | None | Meet Coutts’ requirements for net worth (e.g., bring investable assets totaling more than 1 million pounds or prove that you will imminently come into wealth). |

| Sberbank Visa Infinite Gold Card | $2,000 | $100,000 | Receive an invitation. |

| Eurasian Diamond Card Visa Infinite | Approximately $395 to $1185 | Approximately $39,500 | Receive an invitation. |

| Stratus Rewards Visa | $1,500 | Available upon request | Receive a referral from an existing cardmember or Straus Rewards partner company. |

| The Merrill Lynch Octave Black Card | $950 | Available upon request | Have at least $10 million in a Merrill Lynch account. |

| Santander Unlimited Black Card | Approximately $275 | Available upon request |

|

| Luxury Card Mastercard® Gold Card™ | $995 | None | Consider applying only with an excellent credit score. |

What makes a credit card exclusive?

Like the clients who carry them, exclusive credit cards share notable similarities. The following factors can elevate a card’s status and barrier to entry.

- High cost. Some cards are issued at no cost to high net worth members. More commonly, exclusive cards come with high annual fees of $1,000 or more, and some require additional initiation fees. At the extreme, a card might cost an outrageous $100,000.

- Available only to a select few. Card providers make it more difficult to get exclusive cards by making their products invite only, requiring the backing of existing members or imposing minimum investment quotas. To join the club, you must have the ability to pull strings — or flash enough money to barrel your way in.

- Made of rare materials. An exclusive credit card should feel exclusive. That’s why it’s not made of plain plastic, instead boasting such precious metals as gold, titanium or palladium. It might even come with inlaid diamonds for good measure.

- Dedicated concierge service. You’ll notice many of the cards on this list offer commonplace features. For example, you can get airport lounge access and travel credits with widely available credit cards. What sets exclusive cards apart is personalized help. Concierge service is standard in premium travel cards, but dedicated concierge services — like account managers expressly assigned to you — are reserved for ultrapremium cards.

- Unadvertised, exclusive perks. One of the reasons we don’t know much about superelite cards is because their issuers like it that way. If a premium card gets you access to a top-notch airport lounge, an ultrapremium card gets you a dedicated space inside that lounge. The less the public knows about these privileges, the more special they tend to be.

- Sky-high credit limits. Exclusive credit cards often come with extremely generous credit limits. Of course, your provider may cut you off if your spending appears to exceed what your net worth allows. But if your coffers sound truly endless, the bank may allow literally any purchase your heart desires.

What is a black card?

A black credit card is a premium credit card that offers more status and benefits than standard, gold or platinum credit cards. The use of the term “black” for this type of credit card refers to the level of the account, similar to how airline and hotel programs have different status levels.

In the case of credit cards, black credit cards are the top rung of the status ladder, offering more premium features and services than platinum, gold and standard options. They’re typically offered by invite-only, and you’ll find they’re designed for the highest earners and spenders — with distinctive perks ranging from generous rewards programs and insurance policies to dedicated concierge services, travel credits and more.

How do you get an invite for an exclusive credit card?

For the most part, getting an invite for an exclusive credit card requires a high net worth and an excellent credit score. You may also need to be a private banking customer of the issuing bank.

If you’d like one of these cards, start building your wealth slowly. Doing that involves mastering financial principles like saving, investing and using credit responsibly.

Regardless of where you are in your financial journey, Finder is here to support you. We’re thrilled to share with you everything we know. And we can’t wait to see you with an exclusive credit card of your own.

The most prestigious credit cards you can actually get

Let’s be real: many of the most prestigous credit cards listed on this page are out of reach for most US consumers. However, there are a number of “luxury” cards on the market that cardholders with a good credit score can get. These include cards such as the Chase Sapphire Reserve, The Platinum Card from American Express, and the Luxury Card Mastercard® Black Card™, which is often mistaken for the Amex Black Card.

These cards require a very strong credit score and demand a high annual fee — up to $550 in many cases. For the price however, you get a smorgasbord of features, including travel statement credits, airline lounge access, discounts or upgrades at luxury hotels and more. These perks are worth hundreds of dollars on their own, making these luxury cards a great deal if you take advantage of the card features.

How to make a luxury credit card pay off

There’s only one way to make a luxury card pay off: use enough of the card’s perks to overcome the card’s large annual fee. No matter how much you enjoy using the card, if you’re not creating enough value through perks to meet or exceed the card’s annual fee then you’re needlessly spending money.

To do this, you’re going to want to look at the entirety of your card’s features. The best way to do this is to sign in to your card account page and find the section on card benefits.

Compare premium credit cards

The following cards have premium benefits, and you can apply for them without an invite. As usual, consider your credit score and apply only for cards you have a good chance of being approved for.

For more options, visit our Credit Card Finder to compare 400+ cards.

Capital One Venture X Rewards Credit Card |

Chase Sapphire Reserve® |

Luxury Card Mastercard® Black Card™ |

|

|

|

|

★★★★★ |

★★★★★ |

★★★★★ Finder rating 3.3 / 5 |

|

|

|

|

|

Minimum credit score 740 |

Minimum credit score 740 |

Minimum credit score 700 |

|

Annual fee $395 |

Annual fee $550 |

Annual fee $495 |

|

Purchase APR 19.99% - 29.24% variable |

Purchase APR Up to 28.49% variable |

Purchase APR 19.49% to 27.49% variable based on your creditworthiness and other factors |

|

Balance transfer APR 19.99% - 29.24% variable Balance Transfer Fee applies to balances transferred at a promotional rate (0% at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you) |

Balance transfer APR 19.99% to 28.49% variable |

Balance transfer APR 0% intro for the first 15 billing cycles following each balance transfer that posts to your account within 45 days of account opening (then 19.49% to 27.49% variable based on your creditworthiness and other factors) This APR will vary with the market based on the Prime Rate. Balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater |

|

Rewards Up to 10x miles |

Rewards Up to 10x points |

Rewards Up to 1x points |

|

Welcome offer

75,000 miles after you spend $4,000 in your first 3 months of account opening |

Welcome offer Earn 125,000 points after spending $6,000 in the first 3 months, from account opening. That's $900 toward travel when you redeem through Chase Ultimate Rewards® |

Welcome offer N/A |

Compare even more credit cards

Ask a question

More guides on Finder

-

7 Credit Cards without SSN Requirements

Credit cards like Firstcard, Capital One Quicksilver, Blue Cash Everyday and Fizz don’t require a social security number to open.

-

7 Best Credit Cards for Young Adults

The best credit cards for young adults are cards with low or no credit score requirements, low or no interest and rewards to go around.

-

Black Friday statistics 2025

Americans love a good deal, but how many people will be shopping Black Friday sales this year?

-

$983.3 million to be spent on turkeys for Thanksgiving 2024

Americans are forecast to spend $983.3 million on Thanksgiving turkeys in 2024.

-

Best 0% APR credit cards

The 6 best cards that charge zero interest include Step Black Card, Chime Card™, Varo Believe, Cleo Credit Builder and more.

-

Best second credit cards to complement your first

Here are 5 of the best second credit cards to complement your first.

-

Best unsecured credit cards for bad credit

Compare the best unsecured credit cards that accept poor credit.

-

Apple Card review

Frequent Apple Pay users are likely to get the most use out of the no-fee Apple Card.

-

Delta SkyMiles® Gold American Express Card vs. Capital One Venture Rewards Credit Card

Which of these two travel credit cards can make your spending go the distance?

-

How much will Americans spend on Jack-o’-Lanterns this Halloween?

Finder looks into the cost of a pumpkin for 2025 which shows Americans plan to spend $834 million pumpkin bill for Halloween.