If you’re using your credit card to make a purchase online or over the phone, you’ll usually be asked to provide the name on your card, the account number, expiration date and something called your CVV or CVC number. These three or four digits are located on the back of your card and are used to help secure your finances when using your card. Use this guide to find out what these numbers mean, what they’re used for and how they help protect your credit card.

Key takeaways

- CVV stands for Card Verification Value, and CVC stands for Card Verification Code.

- CVV and CVC numbers are an antifraud measure.

- Debit and credit cards have this number on the front or back of the card.

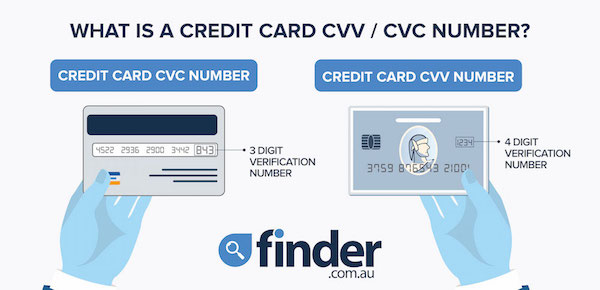

- A CVV or CVC number can be three or four digits.

- Providing a CVV or CVC is often required for over-the-phone or online transactions.

What is a CVV or CVC number?

Your CVV number (or card verification value) or CVC (card verification code) on your credit card or debit card is a three or four-digit number on your card. If you have a Visa or Mastercard branded credit or debit card, it’ll be a 3 digit number located on the back of your card. If you’re using an American Express-issued card, the CVV will be a four-digit number found on the front of your card.

The CVV is an antifraud measure used when you’re making a purchase but aren’t required to enter a PIN or sign a receipt. This is why you’re often asked to enter your CVV number if you’re shopping online or making a purchase over the phone. That’s so the merchant or payee can verify that you are indeed the cardholder and to avoid people using your card for fraudulent transactions.

As the CVV or CVC number is only printed on your card, it’s important that you keep your card safe and secure. If your card is lost or stolen, anyone could use the card to make online purchases or over the phone transactions without your permission. If this does happen, contact your card issuer immediately to cancel the card and keep an eye on your statement to report any fraudulent transactions. The CVV or CVC number is considered a Secure Socket Layer (SSL), which is commonly used technology which is a digitally provided certification process.

Is a CVV or CVC number called anything else?

The credit card CVC and CVV numbers are sometimes called different things depending on the credit card network or credit card company its issues through. For example, Mastercard calls the code CVC2, American Express refers to it as CID, Discover calls their code CID2, and Visa has dubbed it CVV2.

Despite these different names, the codes all serve the same function and are used as a standardized security measure. In the case of “contactless” cards there is generally a chip involved which supplies its own electronically generated series of codes. They are called Dynamic CVV or iCVV.

Are CVV or CVC numbers the same as my PIN?

No, your CVV or CVC number is different to the PIN code you use to make ATM withdrawals of EFTPOS transactions in-store. On the other hand, your CVC or CVV number is used for verifying online or over the phone payments when you can’t use your PIN or signature.

The CVV or CVC number is in place to protect your credit card from fraudulent transactions or phishing scams when using your card for online or phone transactions, but there could still be chances that your credit card might become compromised. Only use your credit card on secure sites and keep track of your credit card statement to spot any suspicious transactions. If you do come across one, make sure to contact your bank immediately to report the issue and protect your finances.

Who is most likely to be researching CCV/CVC numbers?

Finder data suggests that men aged 18-24 are most likely to be researching this topic.

| Response | Male (%) | Female (%) |

|---|---|---|

| 65+ | 4.90% | 3.93% |

| 55-64 | 6.81% | 4.77% |

| 45-54 | 7.82% | 5.61% |

| 35-44 | 9.19% | 7.78% |

| 25-34 | 11.89% | 7.73% |

| 18-24 | 19.40% | 10.16% |

Ask a question

8 Responses

More guides on Finder

-

7 Credit Cards without SSN Requirements

Credit cards like Firstcard, Capital One Quicksilver, Blue Cash Everyday and Fizz don’t require a social security number to open.

-

7 Best Credit Cards for Young Adults

The best credit cards for young adults are cards with low or no credit score requirements, low or no interest and rewards to go around.

-

Black Friday statistics 2025

Americans love a good deal, but how many people will be shopping Black Friday sales this year?

-

$983.3 million to be spent on turkeys for Thanksgiving 2024

Americans are forecast to spend $983.3 million on Thanksgiving turkeys in 2024.

-

Best 0% APR credit cards

The 6 best cards that charge zero interest include Step Black Card, Chime Card™, Varo Believe, Cleo Credit Builder and more.

-

Best second credit cards to complement your first

Here are 5 of the best second credit cards to complement your first.

-

Best unsecured credit cards for bad credit

Compare the best unsecured credit cards that accept poor credit.

-

Apple Card review

Frequent Apple Pay users are likely to get the most use out of the no-fee Apple Card.

-

Delta SkyMiles® Gold American Express Card vs. Capital One Venture Rewards Credit Card

Which of these two travel credit cards can make your spending go the distance?

-

How much will Americans spend on Jack-o’-Lanterns this Halloween?

Finder looks into the cost of a pumpkin for 2025 which shows Americans plan to spend $834 million pumpkin bill for Halloween.

Where is the CVV2 number in a card?

Hello Mahesh,

Thank you for your comment.

A CVV2 code is a security feature of a debit card that is consisting of 3 digits and is located on the back of the card within the signature area. There may be a longer series of numbers but only the last three digits make up the CVV2 code.

Regards,

Jhezelyn

Display CVV number please.

Hi Nilesh,

Thank you for your comment.

CVV is an anti-fraud security feature to help verify that you are in possession of your credit card. For Visa/Mastercard, the three-digit CVV number is printed on the signature panel on the back of the card immediately after the card’s account number. For American Express, the four-digit CVV number is printed on the front of the card above the card account number.

Providing your CVV number to an online merchant proves that you actually have the physical credit or debit card. So, unfortunately, CVV numbers are not to be displayed online.

Regards,

Jhezelyn

I have given all the numbers on the back of my card not just last three is that safe

Hi Beryl,

Thanks for your inquiry

Please note that these are very sensitive information you’re giving out. You have to make sure you’re transacting with a legitimate business or entity. It is our responsibility to make sure we are dealing with the right people. There are lots of fraudulent activities on the internet nowadays and it would be best that we’re always vigilant.

Hope this information helps

Cheers,

Arnold

How do I get my CVV number

Hi Darius,

Thanks for contacting finder, a comparison website and general information service.

If you have a Visa or Mastercard branded credit or debit card, it’ll be a 3 digit number located on the back of your card. On the other hand, if you’re using an American Express issued card, the CVV will be a four-digit number found on the front of your card.

On the page you’re reading, you may also check the where they are located by viewing the sample pictures.

Best regards,

Judith