The best Wine stocks depend on your portfolio and investment goals—while volatility can be ideal for day traders, long-term investors will want to look to stocks with steadier gains over time.

5 popular Wine stocks to watch

We round up a selection of stocks in or related to the vineyard industry, weighting the list more heavily towards popular mid- and large-cap stocks.

- Willamette Valley Vineyards (WVVI)

- Brown-Forman Corporation (BF-B)

- Andrew Peller (ADW-B)

- Corby Spirit and Wine (CSW-B)

- Constellation Brands Inc Class A (STZ)

Compare investment accounts that help you research stocks

The Wine stocks industry is affected by a range of complex factors such as trade policies, regulations, and fluctuating supply and demand. So when considering Wine stocks to buy, it's important that you have access to vital information about a company's financial health, leadership team, and market positioning.

Our picks for platforms with research tools

How to invest in Wine stocks

- Choose an online stock trading platform. Choose from our Top Picks above, use our comparison table below or jump straight to the best stock trading apps in Canada.

- Sign up for an account. Provide your personal information and sign up.

- Set up a funding method to pay for the transaction. Deposit funds into your account by linking your banking information.

- Choose the stocks you want to buy. Search for the stock by name or ticker symbol like WVVI or BF-B.

- Place your order. Buy the stock. It's that simple.

Learn more about popular Wine stocks

We round up a selection of stocks in or related to the vineyard industry, weighting the list more heavily towards popular mid- and large-cap US stocks.1. Willamette Valley Vineyards (WVVI)

Willamette Valley Vineyards, Inc. produces and sells wine in the United States and internationally. It operates through two segments, Direct Sales and Distributor Sales.

- Previous close price: $6.03

- Market capitalization: $30,233,988

- 1 year performance: 21.82%

2. Brown-Forman Corporation (BF-B)

Brown-Forman Corporation, together with its subsidiaries, manufactures, distills, bottles, imports, exports, markets, and sells various alcoholic beverages. It provides wines, whiskey spirits, whiskey-based flavored liqueurs, ready-to-drink cocktails, ready-to-pour products, vodkas, tequilas, gin, brandy, rum, bourbons, and liqueurs. The company offers its products primarily under the Jack Daniel's, Woodford Reserve, Old Forester, Coopers' Craft, Gentleman Jack, Herradura, el Jimador, Korbel, Sonoma-Cutrer, Finlandia, Chambord, Gin Mare, Diplomático, Fords Gin, The Glendronach, Benriach, Glenglassaugh, and Slane brands.

- Previous close price: $34.71

- Market capitalization: $15,939,352,576

- 1 year performance: -29.25%

- P/E ratio: 16.1675

3. Andrew Peller (ADW-B)

Andrew Peller Limited engages in the production and marketing of wines and craft beverage alcohol products in Canada. The company offers wines under Peller Estates, Trius, Thirty Bench, Wayne Gretzky, Sandhill, Red Rooster, Black Hills Estate Winery, Tinhorn Creek Vineyards, Gray Monk Estate Winery, Raven Conspiracy, and Conviction brands; Peller Family Vineyards, Copper Moon, Black Cellar, and XOXO brands; and Hochtaler, Domaine D'Or, Schloss Laderheim, Royal, and Sommet brands. It also produces craft beverage alcohol products, including ciders under the No Boats on Sunday brand; and seltzers, spirits, and cream whisky products under the Wayne Gretzky No.

- Previous close price: C$5.79

- Market capitalization: $208,472,272

- 1 year performance: 21.13%

- P/E ratio: 57.6

4. Corby Spirit and Wine (CSW-B)

Corby Spirit and Wine Limited, together with its subsidiaries, manufactures, markets, and imports spirits, wines, and ready-to-drink cocktails in Canada, the United States, the United Kingdom, and internationally. It offers its products under the J. P.

- Previous close price: C$13.64

- Market capitalization: $421,502,816

- 1 year performance: 15.11%

- P/E ratio: 14.6196

5. Constellation Brands Inc Class A (STZ)

Constellation Brands, Inc. , together with its subsidiaries, produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy. The company provides beer primarily under the Corona Extra, Corona Familiar, Corona Hard Seltzer, Corona Light, Corona Non-Alcoholic, Corona Premier, Corona Refresca, Modelo Especial, Modelo Chelada, Modelo Negra, Modelo Oro, Victoria, Vicky Chamoy, and Pacifico brands.

- Previous close price: $187.00

- Market capitalization: $33,734,492,160

- 1 year performance: -27.71%

Buy Wine stocks from these online trading platforms

Compare special offers, low fees and a wide range of investment options among top trading platforms.Note: The dollar amounts in the table below are in Canadian dollars.

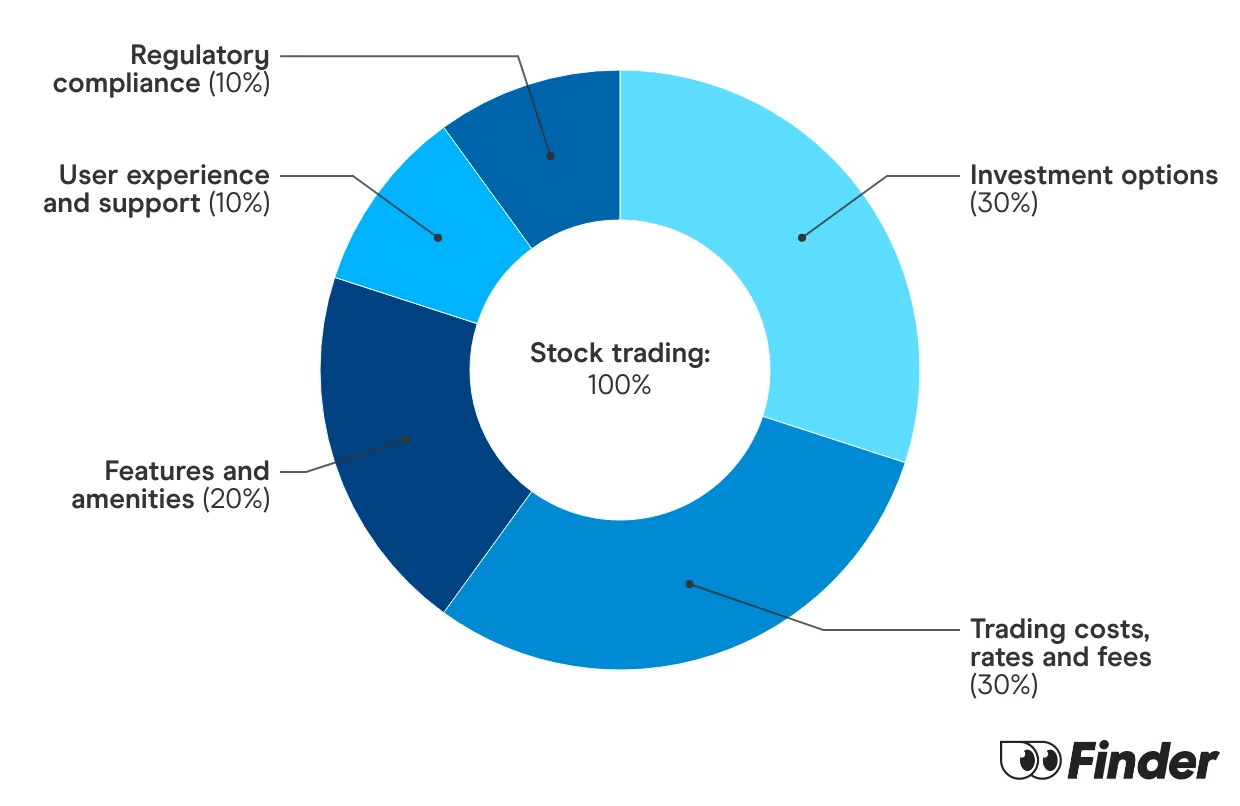

Finder Score for stock trading platforms

To make comparing even easier we came up with the Finder Score. Trading costs, account fees and features across 10+ stock trading platforms and apps are all weighted and scaled to produce a score out of 10. The higher the score the better the platform - simple.

Bottom line

While it's possible to turn a profit investing in Wine stocks, keep in mind that—like any investment—Wine stocks are not immune to risk. These stocks are subject to fluctuating conditions both in the market and in the vineyard industry, so carefully vet your picks before you invest. If you're new to investing or if it's been a while since you've taken a critical look at your investment accounts, compare brokers to make sure you're getting the best trading features for your needs.More on investing

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

Read more…

Meme stocks: What they are and examples of popular stocks

Meme stocks can produce large gains in short periods, but the stocks are volatile.

Read more…

How do ETFs work?

Your guide to how ETFs work and whether this type of investment is right for you.

Read more…More guides on Finder

-

Full guide to paper trading accounts for 2025

How to choose the best paper trading platform to help you learn the ins and outs of investing.

-

How will tariffs affect the stock market?

Find out how the Trump tariffs will impact the stock market and explore Canadian stocks that may be resilient amidst tariffs.

-

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

-

Trading promos & investment account bonuses for 2025

Enjoy perks like free trades and cash back when you open a stock trading account with these online broker promotions.

-

TD Easy Trade review

Use this self-directed trading app to learn the basics of investing with a streamlined app and a number of free trades annually.

-

Best renewable energy stocks

These are the best renewable energy stocks to buy now in Canada.

-

10 best trading platforms and apps in Canada for 2025

Whether you’re a new or experienced investor, these are the best stock trading platforms and apps in Canada.

-

TD Direct Investing Review

Make quick and easy trades using this reputable online trading platform from TD.

-

RBC Direct Investing review

Here’s what you need to know about the benefits and shortcomings of this Big Bank investment platform.

-

Questrade review

Questrade is a leader among Canadian discount brokerages, but is it right for you? Compare fees, features and alternatives here.