There is no such thing as a recession-proof investment, but there are definitely industries, stocks and strategies that tend to perform better in down periods.

The stock market is sensitive to fluctuations in people’s spending, as you’re likely to have noticed with the recent coronavirus outbreak and previous economic downturns. Some stocks can take a dive, but there are other investments considered to be “safe havens” that people usually turn to during a recession.

Here’s what to invest in during a recession, as well as some strategies for investing during economic downturns.

Did you know?

A “safe haven” investment is typically stable in times of market volatility and is also useful for investors looking to diversify their portfolio, decreasing exposure to riskier assets or investments. However, this doesn’t make the investment risk-free and as with all investing, you could still lose your capital.

Defensive stocks

Defensive stocks, also known as consumer staples stocks, include companies that produce goods that the public will still buy them even when financial times are tough or uncertain. People will aways need these staples. Even when we’re all counting our pennies, we’re still spending money (albeit, less money) on things like healthcare, food and utilities. These are the sectors that are more likely to do well while other sectors struggle. You can invest in these stocks through any trading platform.

Compare stock trading platforms to buy defensive stocks

Finder Score for stock trading platforms

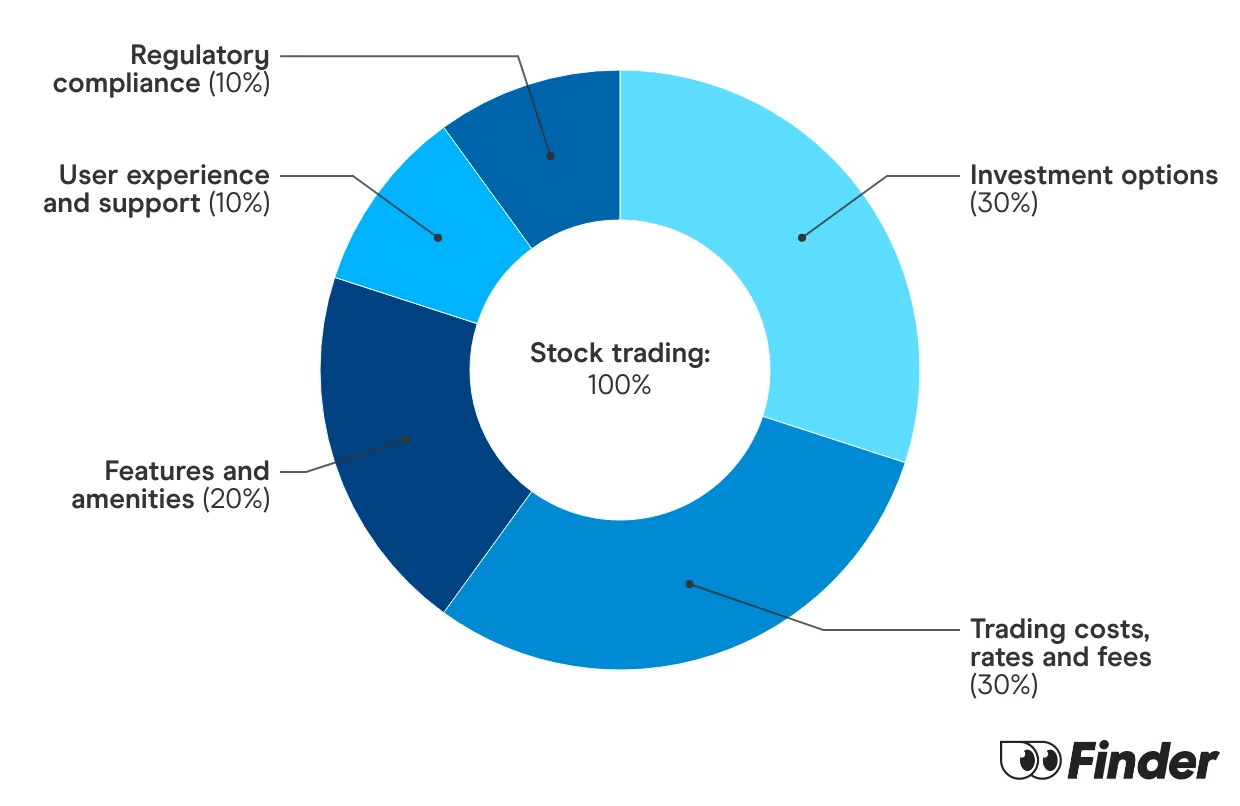

To make comparing even easier we came up with the Finder Score. Trading costs, account fees and features across 10+ stock trading platforms and apps are all weighted and scaled to produce a score out of 10. The higher the score the better the platform - simple.

Property

If you’re already a homeowner, a recession doesn’t do you many favours. However, it can offer some investment opportunities if you can purchase while home values are down.

You don’t have to purchase a home to invest in property. You can invest in property investment funds, invest through peer to peer lending, invest with property ISAs or with land banking schemes. We have a handy guide to investing in property without actually buying property.

Precious metals

This is another product you can invest in without actually purchasing any physical goods. Precious metals such as gold and silver tend to continue to perform while there’s a recession. You’re likely to see the prices rise during this time as the demand for them rises, so you need to snap up a good price early on.

Some currencies

Not all currencies are considered safe havens. It generally depends on the government and the stability of their financial system. For example, the Swiss franc is generally thought to be a safe haven because of the stability of the Swiss government. The euro, US dollar and Japanese yen are also thought to be safe havens.

Foreign exchange (usually known as forex) is the market where currencies are traded, with profits and losses made on the changing exchange rate. Think about when you buy holiday cash, then imagine you sell it back a day later when there’s a different rate. That’s basically forex.

Best stocks to buy during inflation

Tips for investing in a recession

- Play the long game. The most successful investors don’t let times of economic downturn trip them up. They stay invested, even when their portfolio is down due to market volatility because they know that the market always bounces back. (Of course, that’s not to say all individual stocks bounce back, which is why picking your investments wisely during this time is important.)

- Don’t invest money you need in the short term. If you think you’re going to need your money soon, it’s not wise to invest it in stocks that are going to be unstable to start with. This could lead to you needing the money before the market bounces back, so you’ll have to realize any potential losses.

- Stick to large-cap stocks. Large-cap stocks (which usually have valuations worth billions of dollars) are usually more stable and less vulnerable to market fluctuations and volatility.

- Leverage ETFs. ETFs expose you to the market with less risk than stocks do. They automatically diversify your portfolio and spread out your risk. Look at the most resilient sectors and choose an ETF that exposes you to multiple companies in this sector. It’s easier to do well investing in an index that tracks a sector than it is picking specific stocks. For example, if you want to invest only in consumer staples companies, you could buy Vanguard’s Consumer Staples ETF.

- Look for dividend stocks. Even in times of economic downturn, you will still be paid your dividend. Look at consistency of the dividend paid out, not necessarily yield, as higher yields can have higher risks associated.

- Eliminate debt and have money saved up for emergencies. You can make additional savings for investing this way, to ensure that you’re not going to need to withdraw if your boiler fails or car breaks down.

- Avoid the high-risk stocks. Stay a bit cautious when investing during a recession as stocks tend to be a bit more tumultuous. Some industries like tech and non-essentials tend to not perform well during recessions.

The lowdown

There’s not really such a thing as a “recession-proof investment”. Investments are risky. The closest you’ll get to “recession-proof” is safe havens. Save havens tend to be more stable while markets are volatile. Examples of safe havens include:

- Defensive stocks: healthcare, food and utilities

- Property

- Precious metals

- Some currencies

Guide to investing for the future

More on investing

How to invest in the EURO STOXX 50

Want to invest in the Euro Stoxx 50 in Canada? Explore investment platforms and popular Euro Stoxx 50 index funds.

Read more…

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

Read more…

Meme stocks: What they are and examples of popular stocks

Meme stocks can produce large gains in short periods, but the stocks are volatile.

Read more…

How do ETFs work?

Your guide to how ETFs work and whether this type of investment is right for you.

Read more…

How to read stock charts

Learning how to read stock charts and recognize chart patterns can unlock your success as a trader.

Read more…

What are stocks?

Owning a stock means you own part of a company and can potentially grow your wealth. But there is a risk of loss.

Read more…More guides on Finder

-

Private equity vs venture capital: A side-by-side comparison

Both involve private investment, but they differ in focus, strategy and the stage at which they invest in companies.

-

Best short-term investments in Canada

Where to invest your money in the short-term with low risk and high yield.

-

How to trade futures

Futures trading can be rewarding, but it’s not for everyone. Learn the steps to trade futures, including examples and fees to consider.

-

Investment calculator

Use this calculator to find out how much you can grow your money.

-

Investing in your 40s: 8 ways to prepare for retirement

How to invest for retirement: 8 ways to safeguard your portfolio.

-

Investing in your 30s: 8 wealth-building tips

Prepare to revamp your asset allocation and explore new investment classes when you’re in your 30s.

-

How to start investing in your 20s: The 7 tips for beginners

Read our 7 tips for starting a portfolio if you’re new to investing.

-

Real estate investment

Check out these real estate investment options from REITs and rentals to mutual funds, house flipping and more.

-

Questwealth Portfolios vs Wealthsimple: Which robo-advisor is right for you?

Find out which of these popular Canadian robo-advisors you should choose to for your financial situation.

-

What are bonds?

Bonds are fixed-income assets that earn interest. But bonds may underperform other asset classes in the long run.