If you’re new to investing, you can find investment advice from discount brokerages that have little-to-no trading fees and offer libraries of educational material on general finance. You can also work with independent advisors or large investment management firms if your financial goals are more complex. We’ll walk you through 6 places to find investment advice.

Where can I get investment advice?

1. Discount brokerages

Discount brokerages like Wealthsimple, BMO InvestorLine and CIBC Investor’s Edge offer services designed for beginners. You don’t need to open an account to access their educational material online. They offer articles written by experts about the basics of stocks, exchange-traded funds (ETFs), different investment strategies and more.

When you’re ready, you can begin buying and selling shares of stocks and ETFs without paying commission fees. Many discount brokers also let you open an account with no minimum deposit, and you may not be subject to a minimum account balance. However, exact policies can vary between brokers.

However, discount brokers may not be the best option for active investors. Some lack the research tools and investment options one would find with full-service brokers.

2. Financial media

If you’re an active investor or day trader, it’s crucial to stay up-to-date on any reliable market news and research you can get your hands on. These resources can give you a deep understanding of who is moving the markets and where you may find profits. But make sure you vet publications and other sources, as some may be feeding too much into market hype.

3. Robo-advisors

One of the easiest ways to get financial advice is through a robo-advisor. Here’s how it works. You visit the robo-advisor’s website and answer a few questions about your finances, risk tolerance and investment goals. The robo-advisor then recommends a diversified portfolio based on answers to your questions. From there, an advanced algorithm monitors and rebalances your portfolio to keep it on track with your goals. You can transfer your assets to a different portfolio if your circumstances change.

Some robo-advisors like Justwealth give you access to advice from real-life professional financial advisors whenever you have questions.

Robo-advisors are provided by discount brokers like Wealthsimple or full-service brokerages like RBC and BMO. Both types of providers typically give you access to educational material on their websites, and some let you work with human advisors as well.

4. Financial planners

If you want someone to help you manage more than just your investments, consider hiring a certified financial planner (CFP). A CFP can help you manage a budget, pay off high-interest debt, save for retirement and more. If they’re registered with FP Canada, they can also give you investment advice.

CFPs are fiduciaries, which means they are required to provide advice only in your best interests. Their fee structures are usually flexible. Some charge by the hour, while others charge a fee based on a percentage of the investments they manage in your portfolio. This fee can range from 0.05% to more than 1%, depending on the size of your portfolio.

But not all CFPs are created equal. So make sure you do some thorough research before you decide to work with one.

5. Full-service brokers

Regardless of your investment knowledge or income, you can find investment advice at a full-service brokerage. These firms offer services tailored to all levels of investors.

Beginners can find blogs, videos and tutorials about all kinds of investment topics. Many provide account holders with free research tools to help them analyze stocks and develop their investment strategies.

Some well-known companies in this space include Edward Jones, BMO Nesbitt Burns, Desjardins and IG Wealth Management. Experienced investors will have access to teams of financial advisors and analysts who can manage large portfolios. But management fees and investment minimums can vary widely for comprehensive services.

6. Family offices

Family offices provide wealth management services to ultra-high-net-worth families. A family office team can help these individuals achieve many financial goals for generations.

- Retirement planning

- Education funding

- Tax management

- Estate planning

- Charitable giving

- Investing advice

- Debt management

- Will drafting

- Aircraft and yacht management

- Travel planning

- Business management

However, these services don’t come cheap and they’re usually reserved for the most affluent families.

Why is an investment strategy important?

Every investment you make has the potential to grow, but you can also lose it all at any moment. So you need a plan. Make sure your immediate finances are covered before you invest, and be aware of your risk tolerance.

You also need to analyze your investment options carefully and diversify your portfolio strategically. Doing so can net you strong returns while giving you a cushion when the market drops. You can find investment advice at many places. But it’s best to tailor this advice into a strategy that’s uniquely yours.

Finder survey: Which investment services do Canadians use?

Response | |

|---|---|

| I do not use any investment services | 23.61% |

| Financial advisor | 21.49% |

| Cryptocurrency exchange | 10.15% |

| Share trading platform | 9.02% |

| Portfolio management service | 8.02% |

| Other investment app | 6.9% |

| Full-service stock broker | 5.97% |

| Micro-investment app | 5.37% |

| Robo-advisor | 5.37% |

| CFD trading platform | 4.11% |

Now that I have a solid strategy, what are my next steps?

Once you’ve developed a solid investment strategy, put it into action. Open a brokerage account and start building your portfolio.

Compare stock trading platforms

There are plenty of brokers out there. But not all are created equal. Fees, investment types, tools and more can vary widely. So make sure you compare brokerages before you invest.

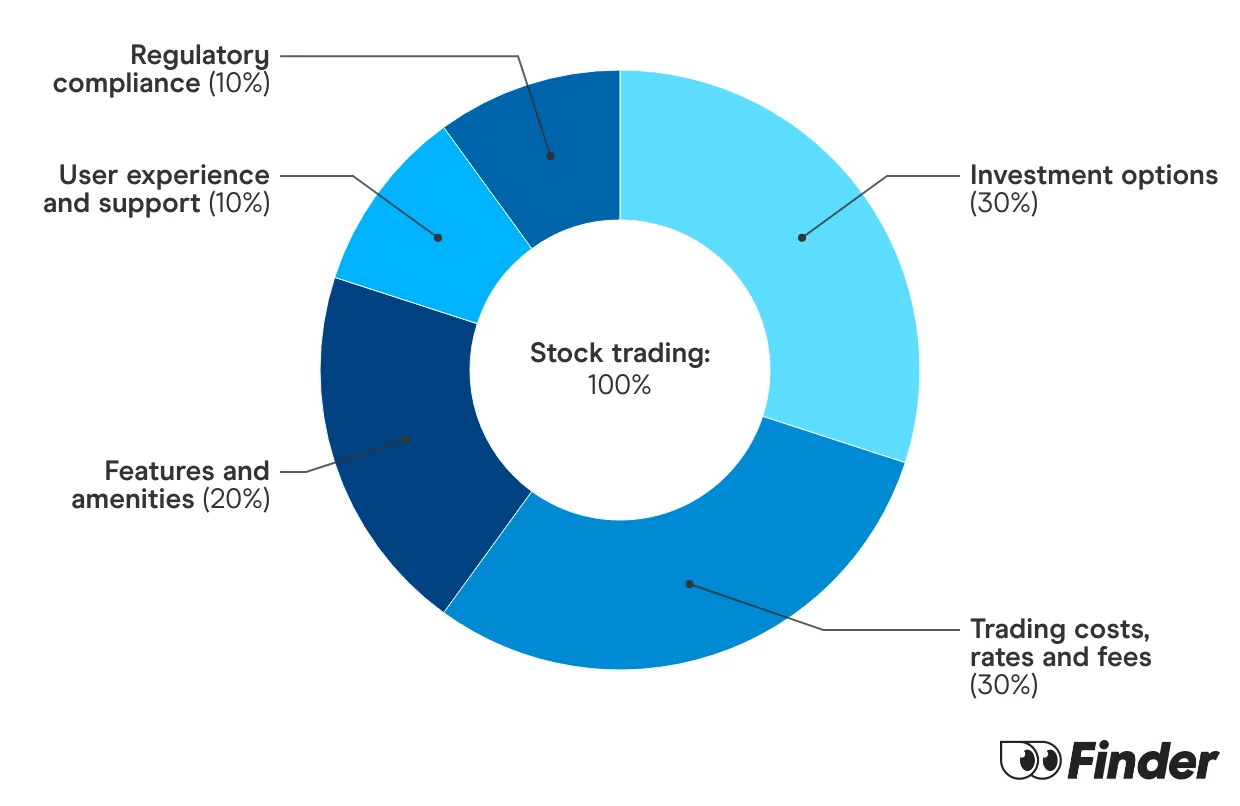

Finder Score for stock trading platforms

To make comparing even easier we came up with the Finder Score. Trading costs, account fees and features across 10+ stock trading platforms and apps are all weighted and scaled to produce a score out of 10. The higher the score the better the platform - simple.

Bottom line

Whether it’s a reliable blog post about investing or a meeting with a Certified Financial Planner, there are plenty of places to find investment advice. Some are more accessible than others depending on your unique situation.

Once when you have the advice you need, compare stock trading platforms and launch your investment strategy.

Frequently asked questions

More on investing

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

Read more…

Meme stocks: What they are and examples of popular stocks

Meme stocks can produce large gains in short periods, but the stocks are volatile.

Read more…

How do ETFs work?

Your guide to how ETFs work and whether this type of investment is right for you.

Read more…

How to read stock charts

Learning how to read stock charts and recognize chart patterns can unlock your success as a trader.

Read more…

What are stocks?

Owning a stock means you own part of a company and can potentially grow your wealth. But there is a risk of loss.

Read more…

How to analyze a stock

Learn how to research stocks and find the right investment opportunities in 4 steps.

Read more…More guides on Finder

-

How to trade futures

Futures trading can be rewarding, but it’s not for everyone. Learn the steps to trade futures, including examples and fees to consider.

-

Investment calculator

Use this calculator to find out how much you can grow your money.

-

Investing in your 40s: 8 ways to prepare for retirement

How to invest for retirement: 8 ways to safeguard your portfolio.

-

Retirement planning

Get actionable tips on how to prepare for your ideal retirement.

-

Investing in your 30s: 8 wealth-building tips

Prepare to revamp your asset allocation and explore new investment classes when you’re in your 30s.

-

How to start investing in your 20s: The 7 tips for beginners

Read our 7 tips for starting a portfolio if you’re new to investing.

-

Real estate investment

Check out these real estate investment options from REITs and rentals to mutual funds, house flipping and more.

-

Questwealth Portfolios vs Wealthsimple: Which robo-advisor is right for you?

Find out which of these popular Canadian robo-advisors you should choose to for your financial situation.

-

What are bonds?

Bonds are fixed-income assets that earn interest. But bonds may underperform other asset classes in the long run.