Send money in 29 currencies

Cashback on hotel bookings

As in the UK, you can use a debit card to make ATM withdrawals, purchases over the counter and get cash out using EFTPOS in New Zealand. Most of the debit cards available to British people will charge an additional fee for currency conversion when you transact in New Zealand dollars. There’s also the international ATM withdrawal fee to think about too.

If you want to apply for a credit card to use overseas, start by looking at the credit cards we’ve listed in the comparison table. Look out for cards that don’t charge a currency conversion fee when you’re transacting in a currency other than British pounds. Some cards also offer up to a number of interest-free days when you pay your balance in full before the end of the statement period, which could help you save on interest costs. Some credit cards also offer complimentary travel insurance, which could save you the time and money you’d need to organise your own.

Don’t use your credit card to withdraw money from an ATM, though. Credit card withdrawals are considered cash advances and will usually incur high interest and a fee. You can avoid some of these fees by loading your own money onto a credit card. Note that the card scheme anti-fraud guarantees don’t apply if you’re using a credit card with a positive balance.

You can hold New Zealand dollars on every prepaid travel card on the market. The benefits of a travel card include that you can load British pounds and convert the funds to New Zealand dollars at a fixed rate of exchange. This means that you can spend in New Zealand without paying extra for currency conversion. You also get a backup travel card, which could come in handy if you lose your card.

There are drawbacks too, however. There are a number of fees on the front and back end, such as international ATM withdrawal fees, card issue fees, initial load fees and reload fees. Some travel cards even charge for inactivity.

Traveller’s cheques have been replaced by other travel money products such as debit cards, credit cards and travel money cards. A cheaper way to get cash in New Zealand is to make an ATM withdrawal. This is especially so if your card provider has a relationship with the bank that owns the ATM. The main advantage of traveller’s cheques is they can be replaced if they’re lost or stolen, and only you can cash them. The card schemes (Mastercard, for example) give you a money-back guarantee if you’re the victim of card fraud. This means traveller’s cheques are often more hassle than they’re worth.

Save on foreign currency exchange fees by using a product which lets you make cheap ATM withdrawals. Currency exchange offices charge a commission to exchange British pounds as well as making money off a margin applied to the exchange rate.

| Auckland | Budget | Mid-range | Expensive |

|---|---|---|---|

| Hostel dorm £15–£20 per night | 2-star hotel £35–£80 per night | 5-star hotel £150–£500+ |

| Vegan and vegetarian diner £5–£10 | Dinner at a mid-range restaurant £25 per person | 5-star restaurant £60+ per person |

| Walking tour of Indigenous New Zealand £15–£30 per person | Waitomo Caves and Rotorua day trip £160 | Skydive from 16,500ft tour £250 |

*Prices are approximate and are subject to change.

If you’re wondering about card acceptance, it works in New Zealand the same as the UK. ATMs are everywhere and nearly all businesses accept EFTPOS payments, which you can use for contactless purchases and to get cash out over the counter when you use your debit card. To give you an idea, 70% of all EFTPOS transactions in New Zealand go through the Worldline (formerly Paymark) system, so there’s no issue using your Visa and Mastercard credit card or debit card. American Express cards are accepted in fewer places than Visa and Mastercard. ATMs are available in most towns with the major banks represented: ANZ, ASB, Bank of New Zealand (BNZ) and Westpac.

| Travel money option | Pros | Cons |

|---|---|---|

| Debit cards for travel |

|

|

| Prepaid travel money cards |

|

|

| Credit cards for travel |

|

|

| Traveller’s cheques |

|

|

| Cash |

|

|

This table is a general summary of the travel money products in the market. Features and benefits can vary between cards.

Mike was travelling in New Zealand and wanted to spend some time in Queenstown, a town in the South Island that is recognised as providing the best overall skiing experience in New Zealand. The snow, the nightlife, the food and the atmosphere are all top notch.

Where did he go?

Mike visited the Coronet Peak resort, which is about 20 minutes away from Queenstown. He stayed in town for a couple of weeks and did the commute each day. He also skied at The Remarkables and Cardrona peaks.

Where could he use his cards?

Mike discovered he could use his debit and credit card almost everywhere, including on the mountain to pay for his ski pass, rental and drinks at the end of the day. However, small purchases like coffee and hot chocolate were mostly cash only. In Queenstown he used his card at restaurants, bars and clubs. He took the shuttle to the mountain and back every day and used his card to purchase 10 tickets at a time from the Queenstown Snow Centre.

What about ATM withdrawals?

Mike used an ATM a couple of times, but was mostly able to pay with his travel Visa debit card. He got cash out when he made purchases with the travel Visa a couple of times. He was able to get up to a hundred dollars on each occasion, but this depends on the merchant and how much cash they have in the till. When he did use the ATM, he had to pay the local ATM operator fee. There were no issues with card acceptance at New Zealand ATMs.

Travel money tips?

If you’re travelling by shuttle bus to the peaks around Queenstown, purchase the tickets in bulk. A single ticket costs NZ$20, but there’s a discount if you purchase packs of 10 or 15 tickets at a time.

* This is a fictional, but realistic, example.

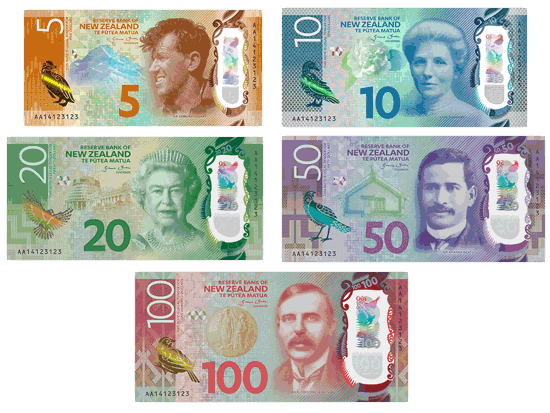

You can bring the British pound equivalent of $10,000 New Zealand dollars with you from the UK. If you take any more than this, you have to declare your cash when you pass through customs. You will get a better deal if you wait to get your money changed in New Zealand, and even better still if you make a withdrawal from an ATM rather than use a money changer. If you want to get your money changed in the UK, have a look at these companies – they can sell your foreign cash.

As a flourishing modern economy New Zealand offers visitors the ability to withdraw cash from a wide range of ATMs across the country. Visa and Mastercard are widely accepted, while American Express can be used but is not as widely accepted by merchants.

New Zealand dollars can be held on pretty much every prepaid travel money card on the market today, leaving you with plenty of choice when it comes to buying currency at a decent, fixed rate. So whether you use cash, prepaid travel money cards or credit and debit cards, you’ll be well accommodated.

Discover what to consider when choosing the best eSIM for Japan, how to get one and how to save yourself money when travelling around the country.

Find out what to consider when choosing the best eSIM for Turkey, how to get one and how to save yourself money when travelling around the country.

In this guide we look at the best eSIMs for travel to the USA, including Revolut, which offers a sign-up bonus of £20.

Compare all your travel money options in one place and see how far your money can go in the land of smiles.

Learn more about your options for spending travel money in Colombia.

Discover the best ways to spend travel money in Fiji.

Here’s all you need to know about the travel debit card that wants to make travelling and spending money abroad hassle free.

The cheapest and easiest ways to use travel money cards, debit and credit cards in the UAE.

Everything you need to know about withdrawing and spending money in Spain. What currency do I need? Do I need a travel card?

Read our comprehensive guide on taking travel money with you to Turkey and compare different travel money services for purchasing lira.