Stats + Facts

We’ve tracked the performance of publicly listed football clubs since the start of 2025 to create a league table of the best and worst performers.

Matt Mckenna runs the communications and content for Finder in the UK after beginning his career at the PR agency, Third City. He has been conducting consumer research and investigations for 9 years within personal finance, with a particular focus on investing, banking and fintech. He is one of Finder’s spokespeople, appearing on Bloomberg, ITV News and BBC Radio as well as being quoted in a range of national publications, and recently sat on the board of Citizens Advice Westminster for a number of years.

We asked Matt about the potential of Artificial Intelligence (AI) within personal finance

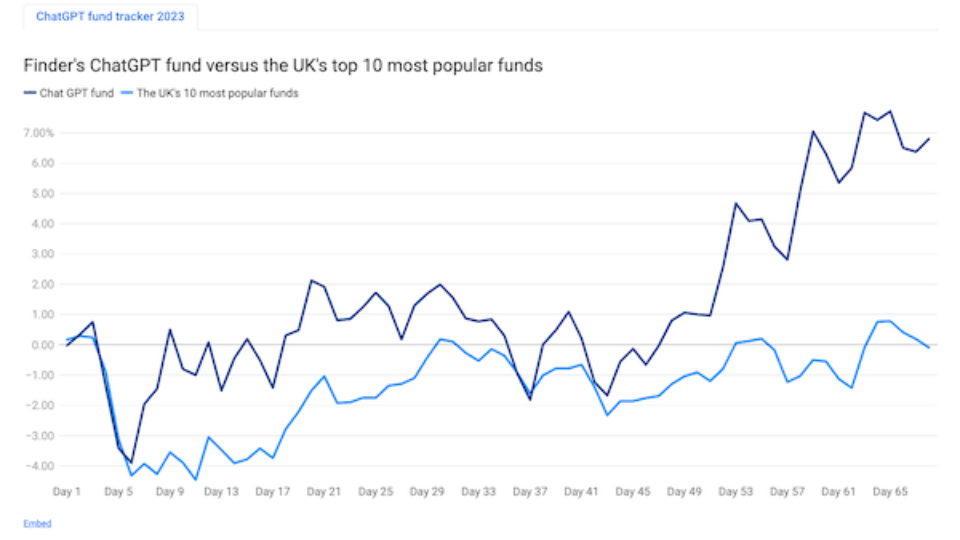

Artificial Intelligence (AI) is no longer the preserve of science fiction movies and it brings a fascinating mix of potential benefits vs risks. As an example, its ability to digest huge amounts of information could help to level the playing field for amateur investors. To help demonstrate this we tasked ChatGPT to create a ‘fund’ that then went on to comprehensively beat the UK’s most popular human-led funds. However, the rising number of deep fake videos and their potential to trick people into losing money is something to be very concerned about. We showed a mixture of real and deep fake clips of celebrities to the public and less than 2% could identify all of them correctly.

16 articles written by this author

We’ve tracked the performance of publicly listed football clubs since the start of 2025 to create a league table of the best and worst performers.

The Finder Score is our objective editorial and insights driven number crunching machine (powered by human experts).

You can use this calculator to find out how much tax on pension contributions you may be able to reclaim from HMRC if your pension scheme uses 'relief at source'.

Changing Help to Buy ISA rules could help more than 2 million first-time buyers

Finder's Freedom Of Information request has found that millions of people could be trapped in Help To Buy (H2B) ISAs due to ISA rules.

Mortgage rate change calculator: How much will my mortgage go up?

Use our mortgage rate change calculator to work out how much your mortgage payments will go up if the interest rate changes.

We looked at how global savings interest rates fared against the UK base rate in 10 countries around the world.

Bank of England base rate predictions: Will interest rates continue to go down?

The Bank of England (BoE) sets the official bank rate 8 times per year. Here at the latest base rate predictions, including expert analysis.

Deepfake scams on the rise in the UK, so learn how you can tell the AI-generated videos from the real ones in our quiz.

An experimental fund of 38 stocks chosen by ChatGPT is up 64.37% after 2 years and 10 months, beating the top 10 funds in the UK.

Find out how the cost of living in the UK has changed over time in comparison to inflation with our historical price tracker.

Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which Finder receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.