Current accounts

We review the pros and cons of the Chase Protect and discuss if the packaged add-on is worth upgrading to.

Kate Steere is an editor and money expert at Finder, specialising in banking, savings and fintech. She has previously written for The Motley Fool UK and Fitch Solutions, where she covered a wide range of personal finance topics and kept a close eye on market trends. Kate has a Bachelor of Arts in Modern History from the University of East Anglia. When not working, she can usually be found curled up with a good book or heading out for a run.

We spoke to Kate about the latest trends in financial education and the housing market in the UK.

The need for meaningful, practical financial education for children in the UK is clear. Schools are stretched, so it’s falling to parents to teach their children about money. However, as our research found, most parents have low confidence about key financial topics. Collectively we need to develop a programme that’s delivered effectively in schools, but also supported by parents, businesses and the third sector. And parents need reliable resources to enable them to teach money confidently at home.

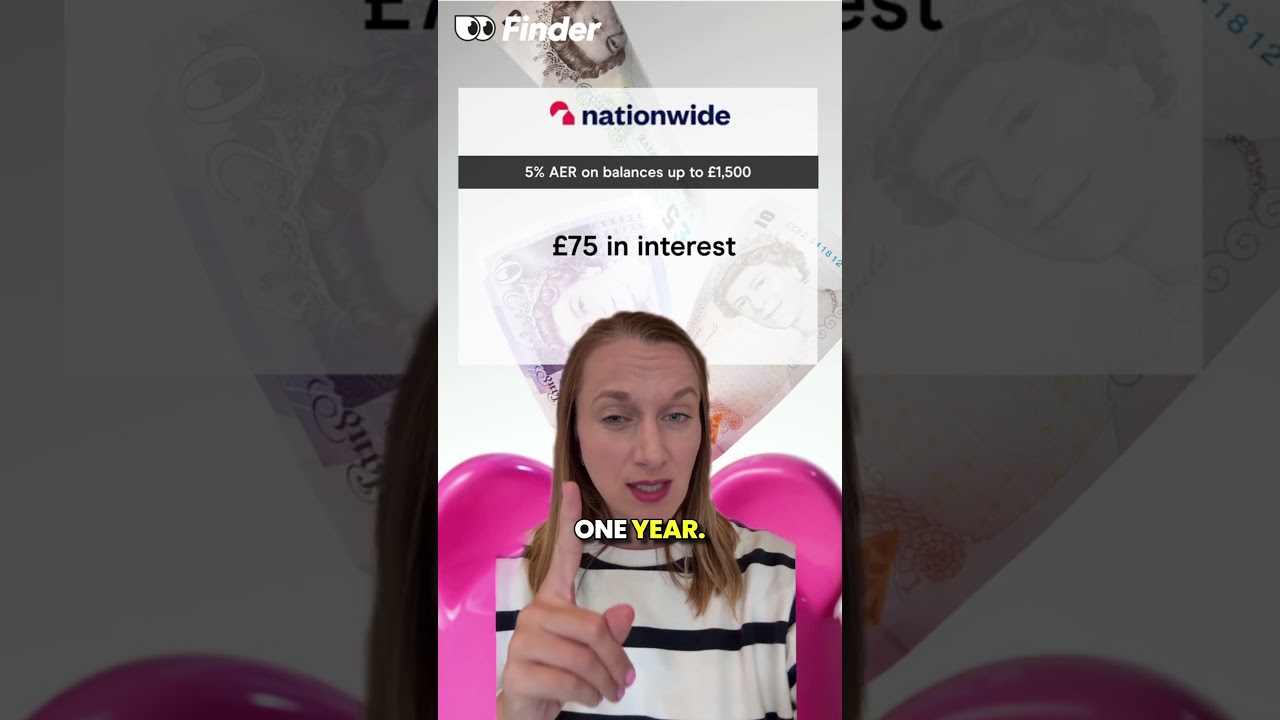

Some premier account perks include preferential rates for mortgages and savings, but in reality, the rates on offer aren’t top of the market and could dissuade you from shopping around.

160 articles written by this author

We review the pros and cons of the Chase Protect and discuss if the packaged add-on is worth upgrading to.

Find out how you can open a new current account with iFast Global Bank and take advantage of the latest switching bonus.

5 payment roadblocks killing your global growth (and how to fix them)

Discover how to navigate common global payment roadblocks and streamline your international operations with WorldFirst. (Paid content)

5 essential money lessons your kids (actually) want to learn in 2026

We’ve partnered with GoHenry to bring you an essential guide outlining the money lessons that kids actually want to learn. (Paid content)

In amongst the festive chaos, Christmas can be a great time to teach the joy of gifting to your kids. We partnered with GoHenry for a Christmas shopping showdown. (Paid content)

Groceries, Netflix, takeaways: The best everyday purchases to rack up points

Discover how to supercharge your points through everyday spending - plus a few ways to redeem them with the American Express® Preferred Rewards Gold Credit Card. (Paid content)

Get your free ticket to Finimize’s Modern Investor Summit 2025

Finder has partnered with Finimize to offer in-person tickets to its Modern Investor Summit on 3 December 2025.

Is a policy with Lemonade worth it? Review and compare Lemonade home Insurance and find out if it makes sense for you and how you can save.

The message from kids is clear - they want money lessons, and they want them now. This research reveals how parents are stepping in to fill the gap. (Paid content)

Find out how you can you can earn from switching to Chase.

Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which Finder receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.