Estimated reading time: 2 min

Due to the potential for losses, the Financial Conduct Authority (FCA) considers this investment to be high risk.

What are the key risks?

1. You could lose all the money you invest

- The performance of most cryptoassets can be highly volatile, with their value dropping as quickly as it can rise. You should be prepared to lose all the money you invest in cryptoassets.

- The cryptoasset market is largely unregulated. There is a risk of losing money or any cryptoassets you purchase due to risks such as cyber-attacks, financial crime and firm failure.

2. You should not expect to be protected if something goes wrong

- The Financial Services Compensation Scheme (FSCS) doesn't protect this type of investment because it's not a 'specified investment' under the UK regulatory regime – in other words, this type of investment isn't recognised as the sort of investment that the FSCS can protect. Learn more by using the FSCS investment protection checker.

- The Financial Ombudsman Service (FOS) will not be able to consider complaints related to this firm or Protection from the Financial Ombudsman Service (FOS) does not cover poor investment performance. If you have a complaint against an FCA regulated firm, FOS may be able to consider it. Learn more about FOS protection here.

3. You may not be able to sell your investment when you want to

- There is no guarantee that investments in cryptoassets can be easily sold at any given time. The ability to sell a cryptoasset depends on various factors, including the supply and demand in the market at that time.

- Operational failings such as technology outages, cyber-attacks and comingling of funds could cause unwanted delay and you may be unable to sell your cryptoassets at the time you want.

4. Cryptoasset investments can be complex

- Investments in cryptoassets can be complex, making it difficult to understand the risks associated with the investment.

- You should do your own research before investing. If something sounds too good to be true, it probably is.

5. Don't put all your eggs in one basket

- Putting all your money into a single type of investment is risky. Spreading your money across different investments makes you less dependent on any one to do well.

- A good rule of thumb is not to invest more than 10% of your money in high-risk investments.

If you are interested in learning more about how to protect yourself, visit the FCA's website here.

For further information about cryptoassets, visit the FCA's website here.

Before you can start trading Bitcoin (BTC), Ether (ETH) or other altcoins, you need to get set up on a crypto exchange. We’ve reviewed some of the best in Ireland which are registered with the relevant authority such as the Central Bank of Ireland or an equivalent watchdog if there’s no base in Ireland. With crypto, using even a registered exchange doesn’t give you any protection as a customer.

After crunching through data on fees, safety records, number of coins and more, we’ve picked exchanges that excel in different categories. We also look for learning tools, because not everyone’s a pro. There’s a quick summary or you can see a mini-review with pros and cons of each one.

- Copy trading features

- Simple 1% trading fee

- Ready-made crypto portfolios

Finder’s best crypto exchanges and trading platforms in Ireland for 2026

- Best for beginners: eToro

- Best for pro trading: Kraken

- Best for a debit card: Uphold

- Best all-in-one finance app: Revolut

- Best exchange overall and best for altcoins: Crypto.com

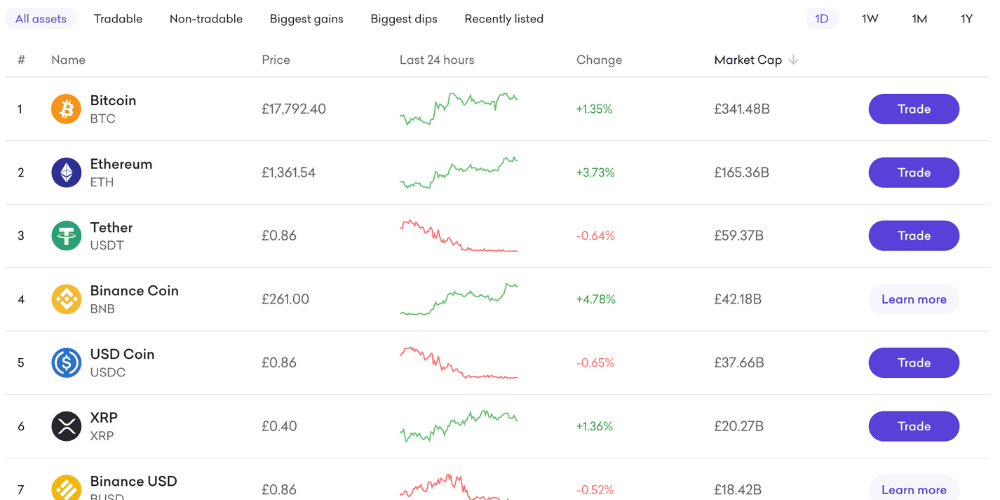

1. eToro: Best for beginners

Supported cryptos

Fiat currencies

eToro uses its experience as an investing platform to make things easy for crypto newbies. Its beginner-friendly interface makes buying and selling crypto quick and simple for someone just starting out.

eToro pioneered the concept of copy trading back in 2010. This feature, known simply as CopyTrader, allows you to view and mirror trades made by experienced investors. To do it, you choose a trader you want to copy and then set your account to follow their trading moves.

With a minimum of US$200, you can automatically repeat trades from some of eToro's top-performing crypto traders - although there's no guarantee they'll keep making a profit. There is no additional fee charged for this service.

Meanwhile, if you want to try before you buy, you can practice with a virtual $100,000 using eToro's virtual portfolio. This allows you to learn about the market and hone your trading skills before doing it for real.

Withdrawals and deposits are made in US dollars instead of pounds, so you’ll have to pay a conversion fee. You can avoid this fee by becoming a Diamond-tier eToro Club member, but that requires a huge account balance of $250,000.

- Unique copy trading feature

- Trades UK and international stocks

- Tiered membership options for advanced traders

- Picking the right trader to copy can be difficult and risky

- Foreign exchange fees on non-USD deposits

- Higher spreads than other exchanges

| Deposit methods | Bank transfer, Credit card, Debit card, Neteller, PayPal, Skrill |

|---|---|

| Deposit fees | Fees vary (conversion fees for non-USD deposits) (US$100 minimum deposit) |

| Withdrawal fees | $5 per withdrawal |

| Trading fees | Fees vary. Overnight and weekend fees apply |

2. Kraken: Best for pro trading

Supported cryptos

Fiat currencies

Kraken is one of the longest-running platforms in the industry and has maintained its legacy by constantly improving its services.

You can start building a cryptocurrency portfolio today from 220+ supported coins. Kraken is popular with over 10 million users, which makes it one of the world's largest exchanges. But for overall features and trading tools, Kraken blows most crypto exchanges out of the water. It's clearly made for traders but it doesn't leave novices behind either.

Kraken Pro, which is free, has a broad range of advanced trading features. It prides itself on offering low spreads and providing deep liquidity across markets so you don't need to worry as much about slippage (which is when the price changes quickly during your order and you feel short-changed). Its interface is also fully customisable, so you can include as many data-displaying tabs and panels as you’d like.

While new traders may feel daunted by the exchange at first, the large variety of guides can help anyone become knowledgeable about cryptocurrency, its underlying technology and the different forms of trading. You'll find these under the 'Learn' tab. It's worth reading the deposit and withdrawal guides in particular - if you use SWIFT, your withdrawal could cost you up to €35. See the 'Fees & deposits' tab in this guide for more about fees.

Meanwhile, more experienced traders will appreciate Kraken's high-quality system and easy-to-use user interface (UI). They'll be pleasantly surprised by how straightforward it is to trade, move crypto and manage assets.

- 220+ supported coins

- Launched in 2013, one of the longest-running crypto exchanges

- Low fees for active traders

- High quality educational guides and tools

- Some trading features unavailable to Ireland users

- High fees on certain payment methods

- No crypto debit card available for spending, unlike some alternatives

| Deposit methods | Bank transfer, Credit card, Cryptocurrency, Debit card, Apple Pay, Google Pay, SWIFT |

|---|---|

| Deposit fees | Fees vary |

| Withdrawal fees | Fees vary |

| Trading fees | Maker: 0.00-0.25% Taker: 0.10-0.40% |

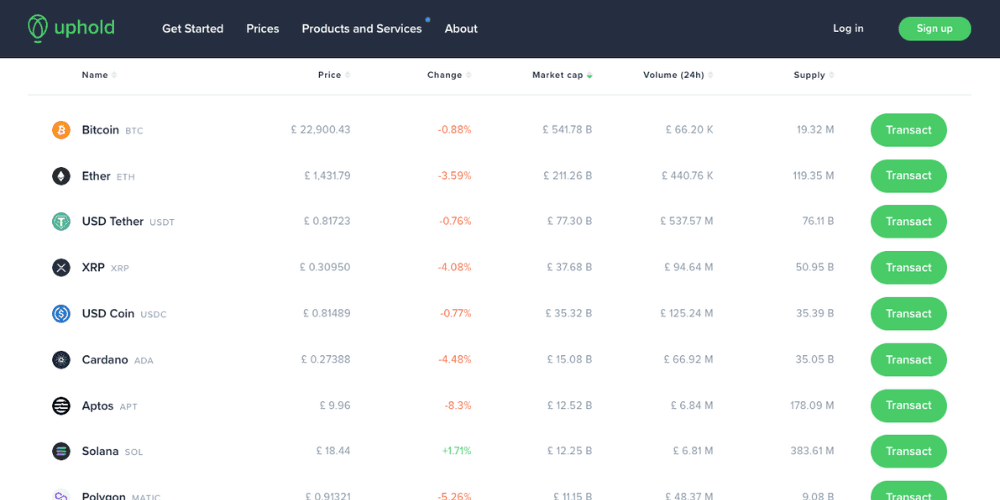

3. Uphold: Best for a debit card

Supported cryptos

Fiat currency

Uphold offers a seamless user experience and a straightforward fee structure. Plus, it has several exciting features like its debit card - although it’s only available in the UK.

The card lets you spend crypto and national currencies wherever Mastercard is accepted. And there are 0% foreign transaction fees and low exchange rates.

Being able to use crypto or national currencies gives you some flexibility. You can also track your spending with real-time analytics and, if you lose your card, you can freeze it using the app.

- Access the value of your assets easily

- Switching funding sources as often as you like

- No fiat deposit

- No foreign transaction fees

- Likely to pay a spread if funding source is not the same

- Crypto withdrawal fees unclear

- Prices not locked in pre-trade

- Cash withdrawals at ATMs incur a fee

| Deposit methods | N/A |

|---|---|

| Deposit fees | N/A |

| Withdrawal fees | N/A |

| Trading fees | N/A |

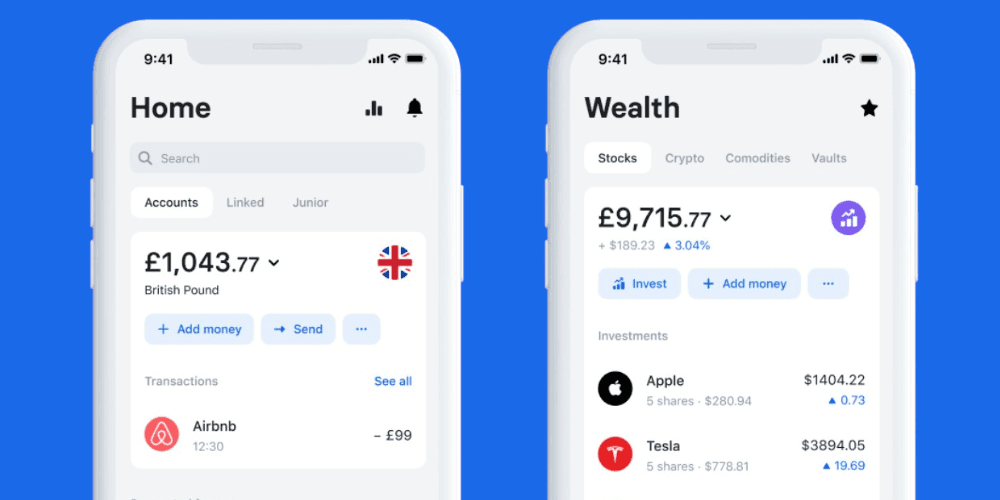

4. Revolut: Best all-in-one finance app

Supported cryptos

Fiat currencies

Revolut is steadily becoming a one-stop shop for all things crypto. The user-friendly digital app marries its e-money banking account services with its cryptocurrency features to create a seamless user experience. Customers can buy, hold and exchange 140+ cryptocurrencies in-app within seconds. Using funds from your Revolut account, you can start investing almost immediately.

From the app, you'll be able to choose which cryptocurrencies to invest in, set up recurring buys, send crypto to other Revolut users and take advantage of performance analytics to help you understand how your portfolio is performing. You can also add a crypto spending mode to your existing Revolut prepaid card, which allows you to pay for purchases with instantly converted tokens. Plus, if you're an advanced trader, Revolut now has its own standalone platform, Revolut X. This desktop platform has lower maker and taker fees than Revolut's standard offering. It also offers full-stack protection and advanced trading analytics.

- Educational resources

- Earn free crypto by watching videos and completing quizzes

- Swap multiple fiat currencies for crypto and vice versa

- Paid monthly plans can add up over time

- Revolut fee on top of network fee on withdrawals

| Deposit methods | Bank transfer, Apple Pay, Google Pay, Debit/credit cards |

|---|---|

| Deposit fees | Free |

| Withdrawal fees | Fees vary (Network fee and Revolut fee) |

| Trading fees | 1.5% per trade (varies with plan) |

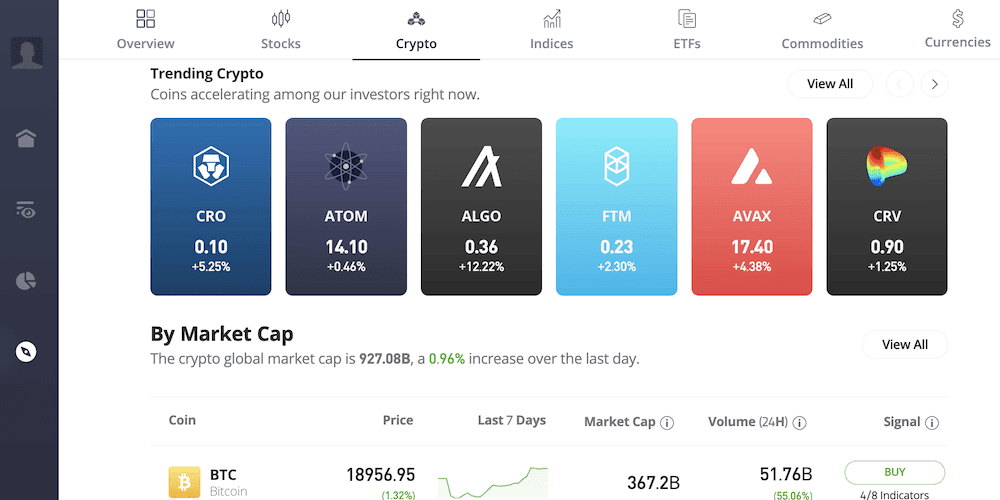

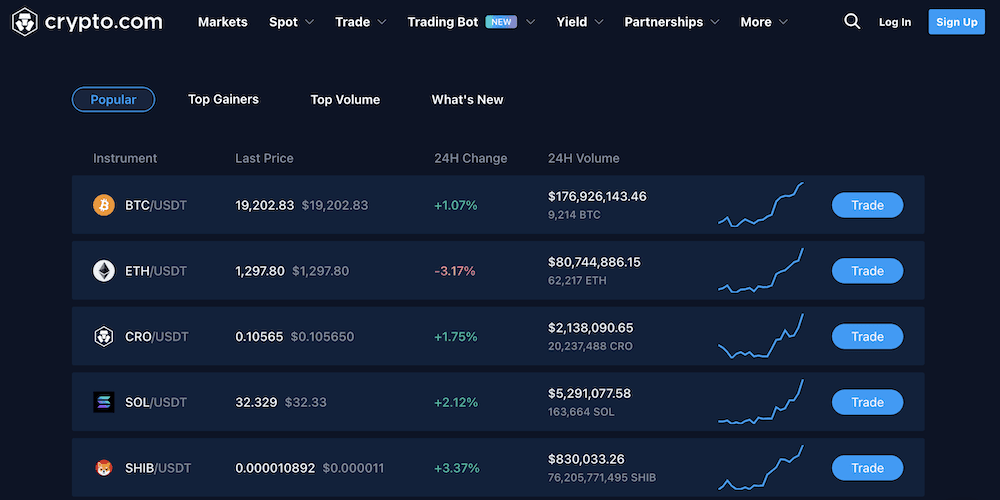

5. Crypto.com: Best overall and best for altcoins

Supported cryptos

Fiat currency

Crypto.com has one of the largest lists of cryptocurrencies with over 380 coins on offer and it’s constantly looking to add more.

If you're looking for less-common altcoins, Crypto.com will have you covered. It has an extensive range of low-market-cap coins and you can see the latest releases in its 'Showroom'. Just remember that coins with a market cap can be even more volatile than the top cryptos, so do plenty of research before plunging in.

Crypto.com also offers other useful services to its 80 million customers worldwide. For example, you can get a crypto card, explore its NFT marketplace or set up your own DeFi wallet. However, not everyone is happy with the service and there are some negative reviews on Trustpilot.

- Buy and sell 380+ cryptocurrencies

- Clean, user-friendly mobile app

- Earn cashback and rewards with a Crypto.com Visa Card

- Staking CRO is required for the highest-yield rewards

- Poorly rated customer service on Trustpilot

| Deposit methods | N/A |

|---|---|

| Deposit fees | N/A |

| Withdrawal fees | N/A |

| Trading fees | N/A |

Why you can trust Finder’s crypto experts

Our comparison tables are completely free to use. We link you directly to the platform’s secure sign-up page and often have offers you won’t find elsewhere.

We’ve researched and rated dozens of exchanges for our Crypto Trading Platform Awards and are often called upon to comment in media.

We’re not owned by an exchange or investment firm. Our opinions are our own and we put our users first to help you find the product that’s right for you.

We’re a team of crypto nerds with extensive experience in investing, trading and decentralised finance but we also remember how it feels to be a beginner.

How to choose the best crypto exchange in Ireland

It’s important to research a wide range of crypto platforms and compare the pros and cons of each option. The best crypto exchange for you depends on what you’re looking for, so consider the following:

Using locally registered exchanges to buy cryptocurrency

There are plenty of places to buy crypto, including platforms founded here in Ireland or based in locations all around the world. Exchanges headquartered locally are required to register with the local watchdog and comply with requirements that don’t apply to global platforms. Depending on your goals, this may have some benefits or drawbacks.

Pros

- Ireland-based exchanges must comply with Irish and EU anti-money laundering (AML) and counter-terrorism financing (CTF) reporting obligations.

- You can usually buy crypto with EUR.

- Exchanges in Ireland typically support local payment methods.

- You may be able to access local customer support.

- Subject to local laws.

Cons

- You’ll need to provide your personal details and proof of ID – a disadvantage if you want to trade anonymously.

- Overseas trading platforms may provide better liquidity.

- Some features are simply not available on local regulator-registered exchanges. For example, margin trading and some altcoins.

Compare more crypto trading platforms and apps in Ireland

Use the table to compare crypto exchanges and platforms on fees, range of cryptos, deposit methods and more. Once you’ve found the right fit, select Go to site to get started.

How to use a cryptocurrency exchange

For the sake of our example, let’s assume that you have €500 that you want to use to buy Bitcoin (BTC).

- Compare cryptocurrency exchanges to find one that offers the right service for you.

- Register for an account on the platform and provide any personal details and proof of ID required.

- Navigate your way to the “Buy” screen.

- Select BTC as the cryptocurrency you want to buy.

- Select your payment currency, which in this case is EUR, and specify the amount you want to spend as €500.

- Select your payment method, such as a debit card payment or bank transfer.

- Enter your payment details, such as your account number if sending a bank transfer or your card number and CVV if paying by card.

- Review the full details of your transaction, including the fees that will apply and the amount of BTC you are purchasing.

- If you’re happy to proceed, click “Buy BTC”.

- Once the transaction has been processed, the BTC will be deposited into your exchange wallet. However, please note that some brokers will automatically send your purchased BTC to an external wallet address that you nominate.

How to pay for your cryptocurrency in Ireland

Crypto exchanges in Ireland support a range of deposit methods, including the following:

- Debit cards

- Bank and wire transfers

- Cryptocurrency transfers

- Peer-to-peer (P2P) payments

- Neteller, Skrill and other online payment services

- SEPA

- SOFORT

Accepted payment methods vary between exchanges. Prior to signing up, it’s worth checking that your preferred payment method is supported.

The different types of cryptocurrency exchanges

The term “exchange” may refer to a variety of cryptocurrency brokers, trading platforms and other services. Different types of exchange are often more geared toward beginners or experienced users.

- Cryptocurrency brokers. Buy directly from cryptocurrency dealers for simple and quick purchases. A broker will facilitate an instant purchase of the digital asset of your choosing and will not offer spot trading.

- Cryptocurrency trading platforms (suited to beginner/intermediate users). Buy and sell cryptocurrency on an open market for competitive fees, a wide selection of cryptocurrencies and optional features like margin trading. Many exchanges now offer brokerage services to be more beginner-friendly.

- Cryptocurrency derivatives platforms (suited to advanced users). These trading platforms don’t sell cryptocurrency outright. Instead, they let certain users trade cryptocurrency derivatives in regions where this restricted-access feature is available. They’re for advanced traders who want high speed, high leverage and deeply liquid platforms with a full range of features.

Risks of using a crypto exchange

- Cybersecurity breaches. Hacks and scams are, unfortunately, commonplace in the crypto space. Exchange-related security breaches and targeted phishing scams remain a major concern for exchanges and their customers.

- Not your keys. “Not your keys, not your crypto” is a common industry saying and refers to holding your digital assets in a wallet that another person or company controls, such as on an exchange. By storing cryptos on an exchange rather than in a non-custodial wallet, you’re relinquishing full ownership of those assets and putting trust in a third party – which some may see as contradictory to the decentralised philosophy of crypto.

- Lack of consumer protection. While crypto exchanges may be registered with a local watchdog, they still lack a lot of consumer protections such as mandatory insurance or strict rules about how user assets are managed.

- Proof of reserves. Since the widely publicised collapse of FTX, many traders and investors have demanded centralised exchanges provide proof of reserves and user deposits. This may be done by a third-party auditor or through the use of on-chain data. Proof of reserves is still an evolving concept, and it’s not clear yet what the best practices are or how reliable it will prove to be.

- Transaction limits. Most crypto trading platforms have daily deposit and withdrawal limits. This means that even though you may have, for example, 10,000 EUR available, you may not be able to access and withdraw the total balance. Transaction limits typically depend on the exchange and tend to increase as you provide additional KYC information.

- Frozen accounts. Crypto exchanges freezing deposits and withdrawals can happen without warning. If your account is frozen, you will not be allowed to remove your funds until the exchange approves or denies your request. It’s less risky to have just a trading balance on an exchange.

- Asset delistings. Centralised exchanges can opt to delist a cryptocurrency at any time. This can happen for numerous reasons, including poor asset performance, security concerns or anti-money laundering (AML) breaches. If delisting is taking place, you will be notified by the exchange and forced to sell your assets or remove them from the platform.

Bottom line

Not all crypto exchanges are created equal and not all crypto buyers and sellers have the same trading needs. The best exchange or platform for one person might not necessarily be the right choice for someone else, so it’s essential to do your own research.

Read our reviews of some of the most popular cryptocurrency exchanges in Ireland and around the world before you decide which to use. Compare the features, fees and pros and cons of each platform and consider whether they align with your investment goals and budget.

We also have a guide to the best crypto exchanges in the UK if you’re based here instead or looking to share it with someone who is.

Frequently asked questions

Finder’s crypto exchange reviews

Methodology

To evaluate our 2026 picks for the best crypto exchanges in Ireland, we compared trading platforms on a range of criteria, including the following:

- Supported assets. Does the platform offer a good breadth of coins, tokens and NFTs?

- Payment methods. What account funding options are available? Does the exchange accept bank transfers, credit and debit cards or crypto-only transfers?

- Fees. What trading fees, withdrawal fees and other miscellaneous charges are levied by the exchange, and are these rates comparable with competitor exchanges?

- User experience. Is the platform simple to use for both beginners and advanced crypto traders?

- Platform features. What tools, charts and functionalities are available on the exchange? Is there support for advanced trading features such as derivatives or hedging?

- Security. What measures are taken by the exchange to protect its customers’ assets and prevent theft or loss? Are additional security features in place, including 2-factor authentication (2FA), cold storage of assets, regular audits and insurance coverage?

- Regulator registration. Is the platform registered with the Central Bank of Ireland?

- Customer support. How do existing users rate the exchange’s customer support? Does the exchange offer various methods of contact, such as email, instant chat, phone or social media?

Sources

Cryptocurrencies aren't regulated in Ireland (or the EU) and there's no regulatory protection from the Deposit Guarantee, Investor Compensation Scheme or Insurance Compensation Fund. Your capital is at risk. Capital gains tax on profits may apply.

Cryptocurrencies are extremely volatile and are unsuitable for most investors. There is a high risk that you will lose some or all of your money, so you should not invest more than you can't afford to lose. Past performance is no guarantee of future results. This content shouldn't be interpreted as a recommendation to invest. Before you invest, you should get advice and fully understand the risks you are taking. Investing in cryptocurrency through a firm that is registered with the Central Bank of Ireland to provide financial services does not protect you from the above risks. Finder, or the author, may have holdings in the cryptocurrencies discussed.

More guides on Finder

-

CoinJar Review

A great option for beginners and security-conscious traders, but you must live within its limited service area.

-

Robinhood crypto review

Read our Robinhood crypto review: pros, cons, fees and more. Find out how to buy, sell and transfer 15 cryptocurrencies on Robinhood Crypto.

-

How to Buy Cryptocurrency: A Beginner’s Step-by-Step Guide

Learn how to buy and store crypto with step-by-step guide and tips on safety.

-

Coinbase vs. Binance

Compare features, fees, security and more to determine whether Coinbase or Binance.US best suits your investment goals.

-

Crypto.com Review

Learn more about the Crypto.com platform in our complete review.

-

eToro Cryptocurrency Review

If you’re thinking of trading cryptocurrency on eToro, make sure you check out our comprehensive eToro Crypto review first.

-

OKX Review

A comprehensive review of the OKX cryptocurrency exchange, its features, fees, pros and cons.

-

Changelly Review

Changelly allows users to directly exchange cryptocurrencies on its platforms, but it lacks full transparency in its fee structure.

-

Kraken Review

Kraken is one of the best exchanges for advanced traders, offering a wide range of useful features and gaining many positive user reviews.

-

Coinbase Review

Our review breaks down the options, fees and features of investing in crypto with Coinbase.