You can redeem Avion points with RBC through the Avion Rewards site, an online shopping platform that lets you use Avion points to pay for flights, merchandise, gift cards and more. You can also use points to pay bills through online banking.

Let’s walk through how the Avion Rewards program works and how to redeem your Avion points across various rewards categories.

How to redeem Avion points

- Log in to your account. Login to avionrewards.com or download the Avion Rewards app for Android or iOS. You’ll need your RBC Online Banking login credentials.

- Browse rewards. See available rewards including flights, travel packages, gift cards and merchandise. You can also convert Avion points into other types of loyalty points, pay down your credit card bill, donate to charity and more.

- Select your reward or transfer points. Once you choose the reward you want, select Pay with Rewards. Alternatively, you can select Transfer Points to aggregate your points across multiple RBC products.

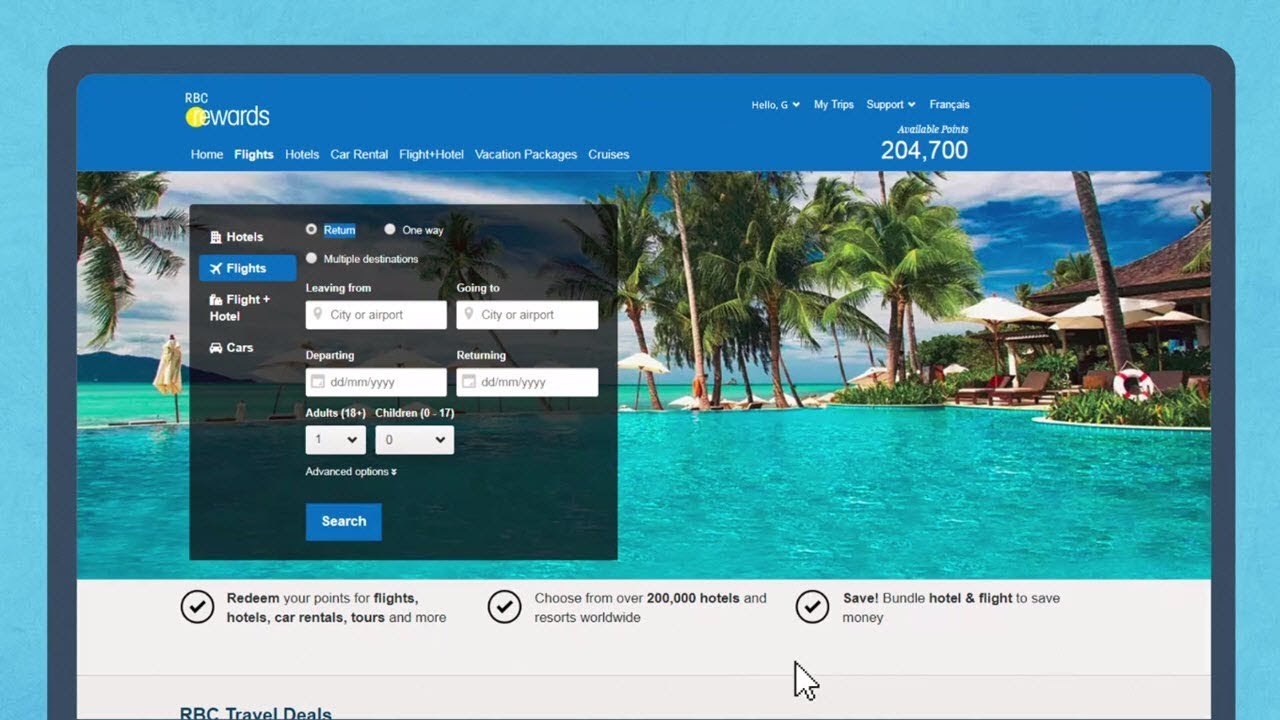

How to redeem Avion points for flights and other travel

When purchasing a flight on the RBC Avion website, you have the option to redeem Avion points when inputting your payment information during the checkout process.

You’ll also be able to convert your Avion points to partner airline loyalty programs such as American Airlines, Asia Miles, British Airways or WestJet Rewards using this online portal.

What makes flight redemptions so special?

Flight redemptions will usually give you the best value when you redeem Avion points. Other features that make flight redemptions unique to Avion include no blackout dates or restrictions and no booking fees.

Your points will also never expire and you’ll be able to use them to cover the taxes and fees on your flight. These are features that aren’t typically available with other frequent flyer programs like Aeroplan.

Who is most likely to be researching how to redeem Avion points?

Finder data suggests that men aged 25-34 are most likely to be researching this topic.

| Response | Male (%) | Female (%) |

|---|---|---|

| 65+ | 8.34% | 8.48% |

| 55-64 | 8.41% | 8.32% |

| 45-54 | 9.04% | 8.09% |

| 35-44 | 9.31% | 7.85% |

| 25-34 | 10.33% | 9.22% |

| 18-24 | 6.36% | 6.25% |

How to redeem Avion points for merchandise & gift cards

Shop for items and gift cards on the Avion Rewards website like you would on any other online marketplace—but pay with points instead of money.

If you want to redeem Avion points for merchandise or gift cards, you can visit RBC’s online rewards catalogue. There are over 100 brands available for gift cards, as well as thousands of consumer goods to purchase including electronics, kitchen appliances, fashion and much more.

You can easily search for the product or gift card you want and redeem your points using your online account. You can also use the portal to make a donation to the charity of your choice.

How to redeem Avion points for bill payments and other RBC financial products

When paying bills online with RBC, select the “Avion Rewards” option on mobile or the “Pay with Avion Rewards Points” tab on desktop to redeem your Avion points.

You’ll be able to redeem Avion points to pay for a number of RBC’s financial products. You can use your points to pay off your credit card, contribute to your investment products, pay off your loans or pay your monthly bills. All you’ll have to do to redeem your points is sign into your RBC online banking account or the RBC Mobile banking app.

What is the RBC Avion Rewards program?

Avion is a bank-specific frequent flyer program operated by the Royal Bank of Canada (one of Canada’s Big Five banks). With this program, you’ll earn points whenever you spend money on your credit card.

There are several Avion credit cards that let you earn between 1 and 3 Avion points for every dollar spent, depending on the card you choose. Points can be redeemed for a wide variety of rewards.

You no longer need to have an RBC credit card to participate in the Avion Rewards program, but you will gain access to higher tiers and more Avion rewards if you do.

Compare Avion credit cards

How much are Avion points worth?

Avion points will be worth different amounts based on how and what you redeem the points for and whether or not you take advantage of a promotion. That said, the average value for each Avion point is approximately 1-2 cents per point.

As a rule of thumb, Avion points are worth more when you cash in those points for flights and other travel-related purchases. The value of Avion points are typically worth less when redeemed for items such as merchandise, gift cards and RBC financial products.

How long will it take to collect Avion points?

The number of points you can earn depends almost exclusively on how much money you spend on your Avion credit card. The average number of points you’ll need to take a short-haul flight between provinces or to some US states is 15,000 points (for a max ticket price of $350). Depending on the RBC Avion credit card, you’ll need to spend $5,000-$15,000 to earn these points.

If you’d prefer to earn points faster, you can check out RBC’s promotions page to see if there are opportunities for you to get more points for making certain purchases or spending money at specific stores.

You may want to pay more for a premium card so that you earn more points for every dollar you spend and get a bigger welcome bonus. It also helps to give additional cards to family members so you can earn points when they shop as well.

How to use your Avion credit card to earn Avion Rewards points

Avion works a little bit differently from frequent flyer programs like Aeroplan because it doesn’t offer a membership, which means you won’t earn bonus points for shopping with certain partners. Instead, you’ll receive a flat rate for spending money on your card.

It’s easy to earn points with the RBC Avion Rewards program as long as you use your Avion credit card on eligible purchases including daily expenses (like gas, groceries and drugstore purchases) along with bill payments and one-off purchases. Some cards offer 1 RBC point for every $1 you spend, while others like the RBC ION+ Visa offer up to 3 points for every $1 spent.

Most Avion credit cards will also give you a welcome bonus when you sign up. With this points surplus, you’ll usually be able to afford at least a short-haul flight anywhere in North America. You can also add this to the points you collect in your first year to redeem for many other rewards.

Another way to earn Avion points faster is to keep track of RBC promotions that allow you to earn more points during limited time promotions. You can also pay more for a premium RBC credit card that let’s you earn more points for every dollar spent — plus most RBC premium credit cards will offer a bigger welcome bonus.

Another easy option is to link your RBC Avion card to your Petro Canada account to earn 20% more points when you fill up on gas or purchase other products at Petro Canada stations across Canada.

Avion vs Aeroplan

Aeroplan and Avion are two popular frequent flyer programs in Canada. Both Avion and Aeroplan offer a good mix of travel rewards and benefits, and come with a number of program-affiliated credit cards. The main difference between Avion vs Aeroplan relates to how your membership in the program works:

- Aeroplan. Aeroplan is a standalone travel rewards program owned by Air Canada that isn’t affiliated with a particular bank. To earn Aeroplan Points (formerly called Aeroplan Miles), you have to sign up for a membership and shop with Aeroplan partners. You can also sign up for a program-affiliated credit card to earn extra points with partners and for making daily purchases.

- Avion. Avion works a bit differently than Aeroplan in that it’s operated by the Royal Bank of Canada (RBC) and doesn’t require a membership to participate. Instead, you have to sign up for an Avion credit card to earn points for making everyday purchases. While you won’t earn points for spending money with partners, the selling feature of Avion is that the rewards are fairly flexible and RBC offers a decent customer service program.

How many points can I earn with Avion vs Aeroplan?

You’ll earn a different number of points with Avion vs Aeroplan depending on what kind of credit card you have and whether you can earn extra points with partners.

- Aeroplan. Aeroplan typically lets you earn one point for every dollar you spend with partners. You can also earn accelerated points when you shop at Aeroplan’s eStore or make purchases with your Aeroplan credit card. Depending on what kind of card you have, you’ll usually be able to earn between 1 and 3 Aeroplan points for every dollar spent on everyday purchases.

- Avion. The number of points you can earn with Avion will depend on what type of Avion credit card you sign up for. Some cards offer 1 Avion Point for every dollar you spend, while others offer 3 points per dollar. It may take you a bit longer to accumulate points since Avion doesn’t have a network of partners, which makes Avion a less desirable option than Aeroplan for many Canadians.

Keep in mind that it’s not possible to transfer Aeroplan Miles to Avion Rewards, or vice versa. This is because the points have different values and there’s no system for bridging your Aeroplan Miles to Avion.

Summary of program differences: Avion vs Aeroplan

| Aeroplan | Avion | |

|---|---|---|

| Operated by: | Air Canada | Royal Bank of Canada |

| Ways to earn points: | With membership and credit card | With RBC credit card only |

| Number of partners: | 250+ partners | No partners |

| Value of points: | Approx. 1.5-2.5 cents | Approx. 1-2 cents |

| Rewards: | Flights, merchandise, gift cards, activities and charitable donations. Points can also be transferred to other Aeroplan members for a fee. | Travel, merchandise, gift cards, charitable donations and RBC Financial rewards. Pay bills or pay down your Avion credit card balance. Convert points to other loyalty program points. Avion Rewards points can be redeemed to make cash contributions to your RESP, RRSP, TFSA or RDSP. Use points for online or mobile trading fees with RBC Direct Investing. |

| Card types: | Aeroplan Visas from CIBC and TD Bank, American Express Aeroplan cards | Avion ION Visa, ION+ Visa, Visa Platinum and Visa Infinite cards like the RBC Avion Visa Infinite card. |

Avion vs Aventura

Aventura is CIBC’s rewards program that offers a series of credit cards that let you earn points for every dollar you spend. These cards include fee-free, premium, business and student cards.

You’ll typically earn between 0.5 and 1.5 points for every dollar you spend on your card, and you’ll get a wide selection of benefits based on how much you pay for the annual fee. It’s also possible that you may be able to cash in on extra points by taking advantage of some of CIBC’s promotional offers.

Just like Avion points, many estimates place the value of Aventura Points at around 1 cent per point. You can redeem Aventura Points for hotel stays, car rentals, merchandise, gift cards and bill payments.

There are no major differences between Avion vs Aventura other than which bank each program belongs to as well as what types of cards you can qualify for. Both programs are well-known for offering flexible rewards, no blackout dates on flights and points that don’t expire.

How to compare Avion credit cards

If you value flexible points over the chance to earn more points on every purchase, an Avion Visa is probably a good fit for you. Compare these features to find the best fit for your needs.

- Return on travel rewards. Earn between 1 and 3 points for every $1 you spend.

- Welcome offers. You’ll get around 3,500 to 55,000 points when you sign up for an Avion credit card.

- Annual fee. The RBC ION Visa costs $0 per year, but more premium cards cost $48-$399 per year.

- Benefits. Each class of card has different benefits, with Visa Infinite cards offering the best bang for your buck.

Deciding if an Avion credit card is the right fit for you

Before you decide on an RBC Avion Visa, you should compare cards from several frequent flyer programs. This will help you narrow down which card best suits your specific lifestyle and spending habits. Compare the following features to get a better idea of which program to go for.

- Points to dollars ratio. Aim for a card associated with the frequent flyer program that gives you the best cash for points value.

- Partner companies. Select the program that partners with the companies you shop at most frequently to earn more points per dollar spent.

- Points redemption. Think about which card gives you the most options for redeeming your points and look at what you can redeem them for aside from airline tickets.

- Available airlines. Look at which airlines are willing to accept your points and what restrictions they might place on bookings.

Bottom line: Are Avion points worth it?

Avion can be worth the time and energy it takes to collect points, especially if you already bank with RBC. Depending on the reward type, you can redeem Avion points through the Avion Rewards website or RBC online banking.

That said, Avion doesn’t work with a network of partners and the points you earn are worth less on average than the miles you’ll accumulate with Aeroplan. The main benefit of Avion points is that you can exchange them for more flexible rewards than what you’ll be able to find with other frequent flyer programs. Avion offers a wider range of redemption options and special perks like no blackout dates and no booking fees when you redeem points for flights.

FAQs about how to redeem Avion points

More guides on Finder

-

How to redeem Aventura Points

Find out how to redeem Aventura Points for flights, travel, items, gift cards, statement credit and more.