On November 18, 2021, KinderCare Learning Companies announced it was postponing its IPO. Here's what we know about the IPO so far and how to buy KinderCare Learning Companies stock in Canada when the company resumes its plans to go public.

Finder's top picks on where to buy KinderCare Learning Companies stock when it goes public

What we know about the KinderCare Learning Companies IPO

On November 8, 2021, KinderCare Learning Companies—a US-based company that owns for-profit child care and early childhood education centers—filed a prospectus with the US Securities and Exchange Commission (SEC).

The company—currently named KC Holdco, LLC—planned to go public on the NYSE under the ticker symbol "KLC." Afterwards, it would be renamed to KinderCare Learning Companies. Stocks were expected to begin trading the week of November 22, 2021.

Less than 2 weeks later, on November 18, KinderCare announced it was postponing the IPO due to regulatory delays. No date has been announced for a future IPO. We'll updated this page as more information becomes available.

Note: all dollar amounts on this page are in US dollars unless otherwise stated.

How to buy KinderCare Learning Companies stock when it starts trading

Once KinderCare Learning Companies goes public, you'll need a brokerage account to invest. Consider opening a brokerage account today so you're ready as soon as the stock hits the market.

- Compare stock trading platforms. Use our comparison table to help you find a platform that fits your needs.

- Open your brokerage account. Complete an application with your details.

- Confirm your payment details. Fund your account.

- Research the stock. Find the stock by name or ticker symbol – KLC – and research it before deciding if it's a good investment for you.

- Purchase now or later. Buy your desired number of stocks with a market order or use a limit order to delay your purchase until the stock reaches a desired price.

Will I be able to buy KinderCare Learning Companies stock in Canada?

You won't be able to buy KinderCare Learning Companies stocks on a Canadian stock exchange like the TSX. Instead, you need a Canadian broker that provides access to international stock exchanges.

You can access US exchanges like the NYSE and the NASDAQ using Canadian trading platforms like Qtrade, Wealthsimple, Scotia iTRADE and CIBC Investor's Edge.

Interactive Brokers provides access to many stock exchanges outside North America like the Hong Kong Stock Exchange (SEHK), Korea Stock Exchange (KSE), National Stock Exchange of India (NSE), Frankfurt Stock Exchange (FWB) and London Stock Exchange (LSE).

Buy KinderCare Learning Companies stock from these online trading platforms

Compare special offers, low fees and a wide range of investment options among top trading platforms.Note: The dollar amounts in the table below are in Canadian dollars.

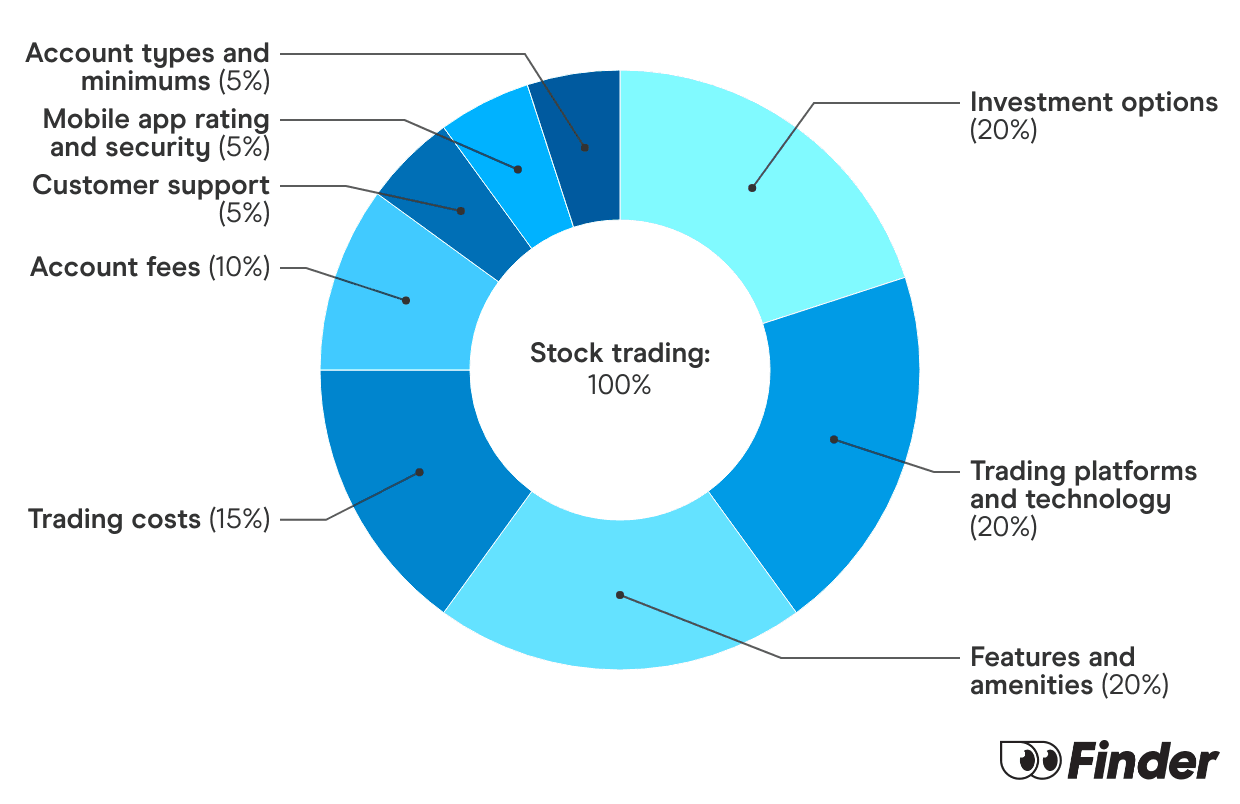

Finder Score for stock trading platforms

To make comparing even easier we came up with the Finder Score. Trading costs, account fees and features across 10+ stock trading platforms and apps are all weighted and scaled to produce a score out of 10. The higher the score the better the platform - simple.

Tax implications of buying US stocks in Canada

Canadians who earn dividends from US stock investments must pay the US Internal Revenue Service (IRS) a 15% withholding tax on their earnings. The rate goes down to 10% for bonds and other interest-yielding US investments.

An exception is made for stock investments held in trusts designed to provide retirement income. This includes RRIFs, LIRAs, LIFs, LRIFs and Prescribed RRIFs. RRSPs that hold US stocks, bonds or ETFs are also exempt from US withholding tax. RESPs, TFSAs and RDSPs are not exempt.

Canadian and international investment income must be declared on your Canadian tax return. Unless your US earnings are exempt from withholding tax, this means you'll be taxed by both the IRS and the CRA. The CRA may allow you to claim foreign tax credits for any taxes you've already paid to the IRS.

Speak with a tax professional to find out what rules and exceptions apply in your circumstances.

More on investing

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

Read more…

Meme stocks: What they are and examples of popular stocks

Meme stocks can produce large gains in short periods, but the stocks are volatile.

Read more…

How do ETFs work?

Your guide to how ETFs work and whether this type of investment is right for you.

Read more…More guides on Finder

-

Can I buy DeepSeek stock in Canada?

DeepSeek isn’t publicly traded, but you can invest in similar companies or swoop in on stocks impacted by the DeepSeek effect.

-

How to buy spot Ethereum ETFs in Canada

Check out a list of Ethereum ETFs in Canada and the US, and find out how to buy an ETH ETF in Canada.

-

What are the best stocks for beginners with little money to invest?

Want to dive into investing but don’t have much to spend? Take a look at these types of stocks.

-

Meme stocks: What they are and examples of popular stocks

Meme stocks can produce large gains in short periods, but the stocks are volatile.

-

Moomoo stock trading review

Is Moomoo Canada worth it? In this review, we break down Moomoo’s fees, features, pros and cons.

-

Where to invest money in Canada in 2025

What’s the best way to invest money in Canada? Find out how to invest money via stocks, bonds, index funds and more.

-

Best renewable energy stocks

These are the best renewable energy stocks to buy now in Canada.

-

10 best stock trading platforms and apps in Canada for 2025

Whether you’re a new or experienced investor, these are the best stock trading platforms and apps in Canada.

-

How to invest in the S&P 500 in Canada

Find out how to invest in the S&P 500 in Canada—one of the world’s most popular stock indices—to diversify your portfolio.

-

Interactive Brokers review

Interactive Brokers makes it easy for Canadian investors to access global exchanges with competitive rates and fees.