While uncommon, some credit card issuers do allow you to perform a debt transfer from another person. Here are the banks that let you do so and the different ways you can perform this transfer.

How to conduct a balance transfer for someone else’s debt

Financial institutions have two main options if you want to transfer someone else’s balance to an account under your name. They are:

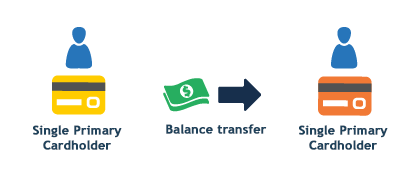

Transferring the balance between two people’s names

In this instance, you would transfer the debt from your partner’s credit card to your own credit card. Their name would be removed from the debt and replaced with yours.

This means you’re the only person legally responsible for the balance. In some cases, credit card issuers will require you to add your partner as an additional cardholder before their debt can be transferred to the new credit card. Otherwise, you may simply be able to transfer the balance from any person’s account to your own.

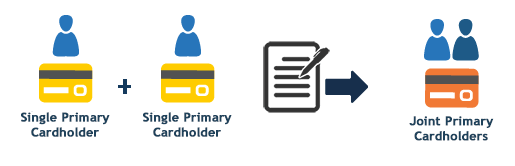

Joint accounts for the debt

Some credit cards and other loans will allow you and your partner to apply for a joint account. This option means that you and your partner would share the legal responsibility for the account and any balance that you transfer onto it.

To get a joint credit card account, both of you would provide your details when applying for the balance transfer credit card. Depending on the issuer, you may also request that your partner is added as a joint account holder after you have applied for the card.

The process of transferring your partner’s balance to a new card depends on which option you choose and the credit card you want to use for the balance transfer. Use the below table as a guide to which banks offer these two balance transfer options for partners.

How to transfer a balance from your partner’s account to your credit card

Most credit card issuers only allow one primary cardholder, so transferring the balance from your partner’s debt to your credit card is the more likely option.

While qualifications and application processes vary between credit card providers, the following steps can be used as a general guide when transferring someone else’s debt to a balance transfer credit card in your name.

Compare credit cards.

Compare 0% balance transfer cards to find one that has the best features for your needs.

Make sure it has a credit limit that supports your balance and you can pay the debt off before the promotional period is up. Also remember that some issuers only allow you to transfer up to a percentage of your credit limit or a flat maximum amount it sets.

Check the balance transfer terms and conditions.

Make sure the credit card allows balance transfers between different account names, and check if your partner will need to be a secondary cardholder. Check the card’s disclosure statement or call the issuer for more information.

Apply for the credit card.

Provide details including your full name, Social Security number, address, driver’s licence or passport number and employment details.

Include details of the balance transfer.

You’ll need to provide details of the account, including your partner’s name and contact info, the account number, the financial institution’s name and the amount of debt to be transferred.

Provide details of secondary cardholders.

If the issuer requires your partner to be a secondary cardholder to process the balance transfer from their account to your new credit card, fill out this section of the application with your partner.

Submit the application.

You should get an initial response within a few minutes. If you get conditional approval, follow the steps outlined by the issuer to complete the application process and finalize the balance transfer.

Once this process is successfully completed, you should receive your new credit card within five to 10 business days, although it could take up to 21 days in some cases. After you activate the new card, the issuer will process the balance transfer.

Stay in touch with the new issuer and be ready to answer any questions or provide supporting documentation if needed to help the transfer run as smoothly as possible.

Who is most likely to be researching transferring someone else's credit card balance?

Finder data suggests that men aged 25-34 are most likely to be researching this topic.

| Response | Male (%) | Female (%) |

|---|---|---|

| 65+ | 2.94% | 2.44% |

| 55-64 | 5.11% | 4.43% |

| 45-54 | 8.84% | 7.68% |

| 35-44 | 14.03% | 12.12% |

| 25-34 | 15.11% | 11.30% |

| 18-24 | 9.65% | 6.35% |

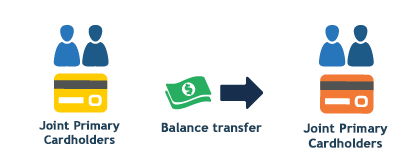

How to transfer to a joint-primary cardholder account

With some credit cards, it’s possible to transfer a balance from a joint account, or transfer your partner’s credit card debt to a new joint credit card account. Not all credit cards or issuers allow you to have a joint credit card account, so make sure you choose a card that offers this feature.

To transfer a balance from an existing joint account

Apply for the credit card and include details of the balance transfer request, including all the names of the joint account holders, the account number, financial institution and the amount of debt you want to transfer.

You can go through this process with an individual credit card in your name, or apply for a credit card that offers joint account status for you and your partner.

To transfer a balance from your partner’s account to a new joint credit card account

Find a credit card issuer that allows joint primary cardholders and compare its balance transfer credit cards. Depending on the issuer, you’ll either get joint account status immediately or apply as an individual and add your partner.

Should I transfer someone else’s credit card balance to mine?

Transferring someone else’s credit card balance to your card could be one way of helping them get out of debt. But here’s what to consider before you commit to this:

- Can you handle the debt? Once you move the debt, you will be liable for paying it off. So, first things first — can you afford to pay the extra debt? If you feel like this may be a burden for your finances, consider it carefully.

- Can you make payment arrangements with the other person? If you are paying for the debt and it isn’t a problem for you, go ahead. Otherwise, talk with the person whose debt you plan to move to your account. Can they make the necessary monthly payments? If not, you could be the one who ends up in debt.

- Can your credit utilization handle the strain? Your credit utilization ratio is one of the key factors that determine your credit score. Once you add extra balance, your utilization rate will increase. Depending on the amount and how long you need to pay off the debt, this can have a negative impact on your credit score. But if you manage to pay it off on time, it may have a positive impact on your credit score.

- Are you really helping the person? Wanting to help someone is an admirable trait. But consider whether you’re doing them a favor or harming them. Consider talking to the person and try to identify the problem.

Should I transfer my credit card balance to another person?

If there’s no way out, moving your credit card balance to another person could be a solution. But beware of the pitfalls. You could end up with less debt but with damaged relations with the person helping you out. If you do decide to make the transfer anyway, try to help out paying the debt.

Dangers of mixing love and money

Money issues can damage even the strongest of relationships. In fact, over a third of Americans say that the would reconsider a relationship due to a partner’s debt. And tied for second place in terms of most unacceptable type of debt is credit card debt.

What is a joint balance transfer?

A joint balance transfer is when a balance is transferred to relieve a partner’s debt. Not all credit card providers allow this, but there are several that give you the option to move your debt to a partner’s credit card.

There are two ways to do this: transfer between two names, or create a joint account for the debt. Transferring between accounts involves moving your balance to a new card with your partner’s name attached.

Which banks offer joint balance transfers?

| Bank/Institution | Types of shared accounts | Balance transfer between two people’s names? | Joint primary cardholders |

|---|---|---|---|

| American Express | Authorized user | ||

| Bank of America | Cosigner or joint account holder; guarantor; authorized user | ||

| Barclaycard | Authorized user | ||

| Capital One | Authorized user | ||

| Chase | Authorized user | ||

| Citibank | Authorized user | ||

| USAA | Joint account holder and authorized user |

What is the difference between joint-primary cardholder accounts and secondary cardholders?

The difference can impact your balance transfer options — and your legal rights — when transferring or sharing debt.

| Joint-primary cardholder accounts | Primary cardholder accounts with secondary cardholders |

|---|---|

| Two people applied for a credit card under both cardholders’ names and have complete access to the account. | One person applied for a credit card in their name but wants to share the account with a partner but without joint account status. |

| Both have the ability to change credit limits, request account freezes or close the account. | Only the primary cardholder has control over credit limit changes, account freezes or account closure. |

| Both partners have regular sources of income and good credit histories. | Only the primary cardholder has to have a regular source of income and a good credit history. |

| Both parties remain liable for all transactions and payments made on the card. | Primary cardholder remains liable for all transactions and payments made on the card — even if a balance has been transferred from an account held by the secondary cardholder. |

| If the closure of an account is the result of a divorce or a separation, both partners might have to pay half of the debt each, no matter who made which purchases. | In the event of a separation or a divorce, only the primary cardholder is liable for any balances on the entire account. |

Mistakes to avoid when transferring a balance from someone else’s card

Whether it’s your own debt or your partner’s, balance transfer credit cards can be a way to save money on interest and pay down the balance faster. But there are some risks involved.

Being aware of the following common missteps will help you make an informed decision about balance transfers for you and your partner when you want to consolidate credit card debt.

- Applying for a card that doesn’t allow balance transfers from someone else’s account.

Not all credit cards let you transfer another person’s credit card debt to a new card in your name. Make sure you check these details before you apply to avoid a declined application. - Not discussing payments with your partner.

If your partner becomes a secondary cardholder on your account, or if you apply for joint account status, it’s important to be clear on how and when you’ll make payments. Discussing this before you apply for a new card or balance transfer reduces the risk of confusion, missed payments or other issues down the road. - Not checking the revert rate.

The low balance transfer interest rate is only available during the introductory period on the card. When this period ends, any outstanding debt from a balance transfer will attract a higher standard interest rate until it’s paid off in full. - Not accounting for balance transfer fees.

You might have to pay a balance transfer fee that can vary from one card provider to the next, typically between 3% and 5% of the balance being transferred.

How does a joint balance transfer affect my credit score?

Your credit score is determined by a number of factors, and it impacts your ability to get a loan or other credit cards. When you decide to take on more debt through a joint balance transfer, one thing’s for certain — your credit is affected.

Transferring debt can raise your debt-to-income ratio and your credit utilization ratio, which weighs how much debt you have compared to how much credit you have available. Both can lower your credit score and affect your ability to qualify for low APRs.

Making regular, on-time payments also will affect your credit score. It’s important to know who’s responsible for making payments and when the due date is. Some credit card companies charge high fees for late payments, and may even end a low introductory rate early.

Bottom line

While it can be difficult to get information about transferring a balance from your partner’s account to a new credit card, it’s possible under some circumstances. Understanding the different options available and the varying conditions of credit card issuers means you can find a balance transfer credit card that fits you and your partner’s debt-relief needs.

Balance transfer calculator

Frequently asked questions

Ask a question

6 Responses

More guides on Finder

-

Best balance transfer credit cards of 2026

Need to save interest on your existing debt? Here are the best balance transfer cards for 2022.

-

Are there 0% interest balance transfer cards for 24 months?

Pay off your debt interest-free with a long 0% intro APR on these balance transfer credit cards.

-

9 diagrams of the balance transfer credit card

Understand why a balance transfer credit card could save you years of interest fees.

I have a Citi credit card it gives me the option to transfer to a checking account in the balance transfer tab can I do a balance transfer from my credit card to my daughter checking account with Citi even when my name is not on her account because it gives me the option to put in a account information?

Hi Alex,

Thank you for visiting finder, we are a comparison website and general information service.

This page listed which banks offer joint balance transfers. Citi does not allow balance transfers between two people’s names or Joint primary cardholders. Should you need further information about the option that allows you to put in an account information, you may need to reach out directly to Citi’s customer care service.

Cheers,

Joanne

When I apply for a credit card at chase bank can I transfer the money on the credit card to another person account?

Hi Yesica,

Thanks for your question.

I would like to confirm, are you referring to depositing money to another person’s bank account using your credit card?

Kindly note that you can’t directly transfer money from your credit card to another person’s bank account. But you could try getting a money transfer service.

With a money transfer service, you can send money to a bank account or for cash pickup, and by paying it through your credit card. However, please note that this type of transaction may attract cash advance interest. Chase and other money transfer companies offer money transfer services.

Cheers,

Anndy

When transferring a credit balance between two people, is this considering giving or receiving income for either party?

For example. Jane owes $4000 on her credit. She transfers the balance to her mom. Is this like receiving $4000 from her mother?

Say for tax purposes or reporting income for child support?

Hi Will,

Thanks for your question.

Assuming one’s credit card debt through a balance transfer can be considered as a gift provided that no payment is expected from the cardholder. Based on IRS gift tax guidelines, generally, the person who receives your gift will not have to pay gift tax because of it. Also, that person will not have to pay income tax on the value of the gift received. Instead, the gift tax will be paid by the donor, the mother in this case, if the value of the gifts given to a person exceeds the annual exclusion of $14,000.

I hope this has answered your question.

Kind regards,

Liezl