Secured Credit Cards

Use our 101 Guide to secured cards to pick the smartest card for you. Compare the best options here — even the cards that don't require a credit check.

Steven Dashiell is an editor for Bankrate and CreditCards.com and formally a personal finance writer at Finder, specializing in credit cards, banking and growing and protecting your income. His insights and expertise has been featured on Nasdaq, U.S. News & World Report, Time, CBS, ABC, Fox Business, Lifehacker and Martha Stewart Living, among other top media. Steve holds a BA in English from University of Maryland, Baltimore County, minoring in composition and rhetoric. In his spare time Steve nerds out on birds, paints and plays a whole lot of Street Fighter.

We sat down with Steve to talk credit cards, banking and industry trends.

While rising interest rates can make borrowing money painful, they also make saving stronger. Most kinds of savings accounts offer higher APYs as interest rates increase, and that means consumers can press the advantage to start earning on their savings. Consumers that already have a savings account should review existing accounts to see if they’re getting a competitive rate. And consider moving their funds if a better rate is available.

Generally, you should never rely on credit cards as a crutch for your financial needs. That’s because the interest that can accrue on credit card balances runs the risk of you falling even further behind financially. You can turn to credit cards to help float your finances during tough times, but first create a plan that allows you to pay off your credit expenses while incurring as little debt as possible.

It depends! If you’re chasing the highest interest rates on the market alongside some excellent mobile banking features, then digital banking is for you. Digital banks also tend to feature handy new saving tools, such as automatic roundups, which round up your purchases to the next dollar and deposit the extra into a savings account. However, you can only manage your digital bank account online, so if you prefer banking in person, you may want to stick with brick-and-mortar banks.

46 articles written by this author

Use our 101 Guide to secured cards to pick the smartest card for you. Compare the best options here — even the cards that don't require a credit check.

Compare alternatives to Signature Bank after its March 2023 collapse. Discover options with no monthly fees and low minimum deposits.

The Finder Crypto Debit Cards and Crypto Credit Cards Awards recognize crypto card products that offer the best value for consumers and have continued to thrive despite a tumultuous 2022 crypto market.

An excellent luxury travel card from Capital One.

A checking account with minimal fees but has an unavoidable monthly service charge.

HMBradley review: A hybrid bank account with an impressive APY

HMBradley is a hybrid checking and savings account that earns up to 3.0% APY.

The free Upgrade Rewards Checking account offers 2% cashback, but you can’t deposit cash.

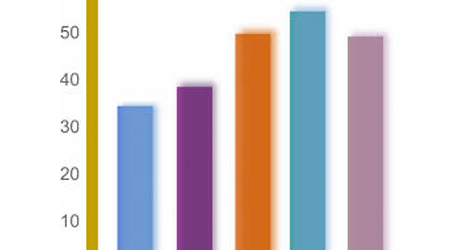

See statistics on balance transfer credit cards, including the average costs, APR, and amount transferred.

Need to save interest on your existing debt? Here are the best balance transfer cards for 2022.

Our top picks for cards across 7 student categories, including international students, first-time cardholders and cashback.

Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which Finder receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.